Film distribution and exhibition are going through a radical metamorphosis. For the first 100 years of film, the business model didn’t change much. In the first five or so decades, audiences had to see movies in cinemas, or never get a chance to see them again. From around the 1950s, movies also appeared on television and in the 1980s the home video market emerged.

Film distribution and exhibition are going through a radical metamorphosis. For the first 100 years of film, the business model didn’t change much. In the first five or so decades, audiences had to see movies in cinemas, or never get a chance to see them again. From around the 1950s, movies also appeared on television and in the 1980s the home video market emerged.

These technologies provided new ways to watch movies but did not change the power dynamic between the industry and audiences. The public had to wait until the industry was ready to sell them access to the movie, and the industry set the terms.

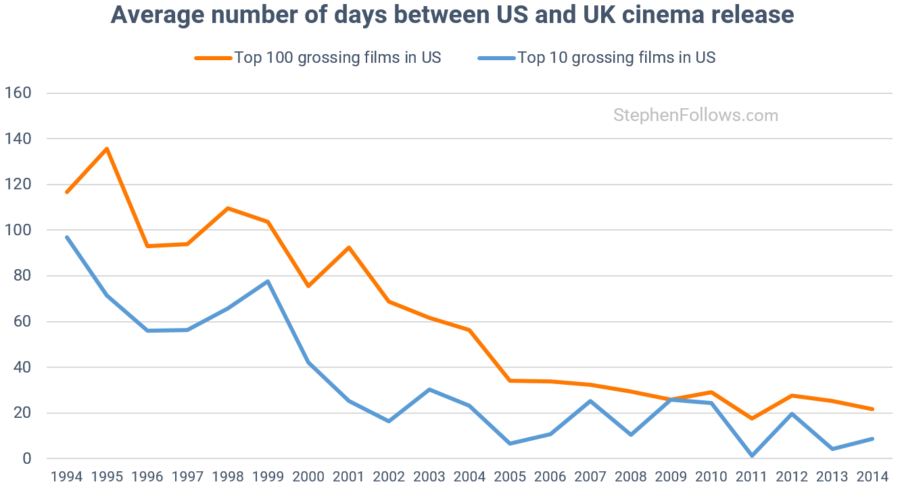

This meant huge delays between a movie appearing on home video or TV, and also it took a long time for a movie to roll out to countries around the world. A couple of years ago I looked at the change in release patterns, showing how the average delay between a US and UK release for a movie had dropped from 134 days in 1995 to just nine days in 2015. Similarly, the gap between release in cinemas and on DVD has fallen by 34% between 2002 and 2014.

The reasons for these shifts come down to three factors…

- Globalisation and the internet have meant that we are all far more connected than ever before. When I was a kid in the 1990s, we had little to no idea of what movies were opening in US cinemas. Movies which were old hat to US teenagers still appeared new and fresh to us when they finally had their UK release six months later. Studios can now run one global marketing campaign, with only a small amount of work from their local offices. This is far cheaper but does require simultaneous release dates.

- Better distribution and exhibition technologies mean that it’s much cheaper and easier to open a film in multiple countries on the same day. In the pre-digital days, a movie had to be physically printed to film and then those film cans were shipped around the world. Now, a Digital Cinema Print (DCP) can be sent via satellite anywhere around the world and duplicated onto rented hard drives.

- The balance of power is shifting away from distributors and exhibitors towards audiences. This trend can be split into three elements:

- Piracy means that distributors are not completely in control of who can see their movie. In the past, as much as you may have hated the time you had to wait or the price you had to pay, you had no choice if you wanted to see the movie. The rise of online piracy changed this because it gave consumers another option. Few mainstream consumers see piracy as a better option than going to the cinema; it requires technical knowledge, the viewing environment is poorer, it removes the social aspect, it’s illegal and can be viewed as immoral. However, the more undesirable going to the cinema becomes, the more appealing piracy appears in comparison. So, if cinema tickets double in price, cinema demand will fall and piracy is likely to rise.

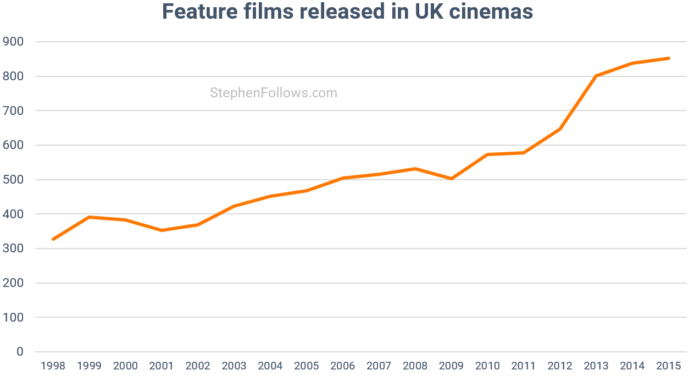

- There has been a sharp rise in the number of movies on release, leading to stiffer competition. At the start of this century, 383 feature films were released in UK cinemas. Fifteen years later, that number had more than doubled to 853 (a fact that even the BFI called “ridiculous“). That’s an average of over 16 new movies every week, meaning that even if you saw two new movies every single day of the year, you would still miss a few. In 2015, there were 171.9 million cinema tickets sold, to a UK population of 64.7 million; meaning people bought the equivalent of fewer than three tickets each. Distributors and exhibitors are having to work ever harder to get people through the doors.

- The emergence of online tools to empower audiences to communicate and organise. In the past, it was hard for cinema-goers to work together to put pressure on the industry to change their release plans. A letter writing campaign organised by a film magazine was never going to make much of a difference. However, in the modern interconnected world, it’s possible to reach and galvanise film fans of a particular genre, filmmaker or movie and use that power to create screenings and sell tickets.

I have touched upon most of the topics above in previous articles, with the exception of the final point. So today I am going to give you a brief overview of ourscreen, a UK leader in audience-created on-demand cinema screenings.

“People-powered cinema”

The basic concept behind ourscreen is pretty simple:

The basic concept behind ourscreen is pretty simple:

- Define the screening. People can pick a movie, a cinema and a timeslot in order to propose a screening.

- Tickets go on sale to the public.

- The screening goes ahead if enough tickets are sold before the predefined deadline. If they don’t reach their ticket goal, then the screening is cancelled and nobody pays anything.

Think Kickstarter meets Odeon.

Here’s how ourscreen describe the process:

Ticket prices vary by venue, with the average ticket price for the 108 screenings currently open at £9.87. The cheapest screening on offer is just £4.00 to see The Weekend at the Vue Cardiff and the most expensive will set you back £16.00 to see the same movie but at the Picturehouse Central, in London.

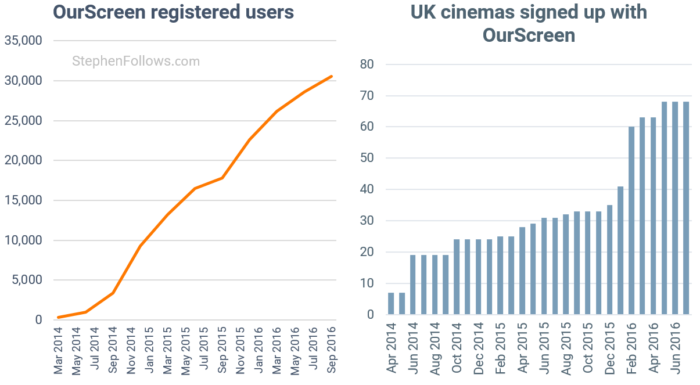

When ourscreen began life in early 2014 it had just seven cinemas and had to build an audience from scratch. They’ve grown quickly and now have 68 cinemas on board and over 30,000 users.

They are constantly adding and removing films from their catalogue, but have an average of 500 at any one time. They point out that if a movie is missing from their catalogue they can still approach the distributor to see if it’s available.

How the ticket pre-sales work

Proposing a screening is the easy bit: the key to success with ourscreen is to get enough tickets pre-sold before the deadline. The threshold for a screening to go ahead is typically that it must have sold at least 30% of the screen’s capacity. ourscreen say that their average threshold is 33 tickets, and their average capacity is 108 seats.

Proposing a screening is the easy bit: the key to success with ourscreen is to get enough tickets pre-sold before the deadline. The threshold for a screening to go ahead is typically that it must have sold at least 30% of the screen’s capacity. ourscreen say that their average threshold is 33 tickets, and their average capacity is 108 seats.

The deadline date is always the Sunday preceding the cinema week, meaning that it falls between 5 and 11 days before the actual screening.

Although this method is great for the die-hard fans (I mean ardent enthusiasts, rather than John McClane groupies) it actually runs counter to how most cinema-goers make decisions and buy tickets. A 2015 Viacom study of 3,000 15-to-34-year-old cinema-goers found that two thirds decided what they’re going to see within a few days of the screening. Added to that a 2015 Wall Street Journal report noted that just 13% of US cinema tickets were bought online. These two factors combined mean that pre-ordering cinema tickets online is not a natural act for conventional cinema audiences.

And we can see this in ourscreen’s sales. Half of all the tickets they sell are purchased after the minimum threshold has been met. This means that some people were waiting to see if the screening was actually going to take place, while others just followed the typical pattern of purchasing late.

Interestingly, ourscreen say that under 5% of their tickets are sold on the day, whereas the Viacom study found that 18% of cinema tickets at conventional screenings were bought on the day.

Just over four fifths of tickets to ourscreen screenings are bought via the ourscreen site, with the remaining 18% being sold in cinemas, once the screening has been confirmed.

Case studies of movies using ourscreen

As there are so many films and cinemas on their books it’s not possible to provide an overall average for how an ourscreen movie performs. However, below are a few case studies to illustrate the numbers behind a successful ourscreen run.

White Island

White Island

- Date range: One night only on 21st October 2016

- Number of screenings created: 38

- Number of confirmed screenings: 23

- Unique visits to the ourscreen page: ~14,000

- Tickets sold: 1,818

- Box office: £19,313

- Average attendance: 79

- Screen average: £840

- Average occupancy: 64%

Northern Soul

Northern Soul

- Date range: October 2014 to February 2015

- Number of screenings created: 135

- Number of confirmed screenings: 32

- Sold out screenings: 25

- Unique visits to the ourscreen page: ~16,000

- Tickets sold: 3,202

- Box office: £27,594

- Average attendance: 100

- Screen average: £862

What We Do in the Shadows

What We Do in the Shadows

- Date range: December 2014 to March 2015

- Number of screenings created: 100

- Number of confirmed screenings: 18

- Sold out screenings: 15

- Unique visits to the ourscreen page: ~21,000

- Tickets sold: 2,760

- Box office: £22,170

- Average attendance: 153

- Screen average: £1,232

The overall screen average for ourscreen movies is £621. It’s tricky to compare this to Hollywood movies as normally what’s reported is the site average, which means that if a film is playing in three screens on one site then the average could be a lot higher than a screen average. For example, last week the weekend site average for Doctor Strange came to £3,122. However, smaller and older releases are extremely unlikely to be playing in more than one screen per site and so they are a fairer comparison. Here are a few of last weekend’s site averages:

- I, Daniel Blake – £1,189

- Bridget Jones’s Baby – £974

- Inferno – £781

- American Honey – £589

- My Scientology Movie – £558

- The Beatles: Eight Days a Week – The Touring Years – £486

- The BFG – £194

So ourscreen screenings compare reasonably favourably, considering that their films are either of a niche interest or are older classics.

How it works behind the scenes

When negotiating with distributors and filmmakers, ourscreen typically offers the following terms:

When negotiating with distributors and filmmakers, ourscreen typically offers the following terms:

- No upfront cost, which is useful to filmmakers if they have failed to get traditional distribution and are facing the prospect of having to hire cinemas themselves. It also means that they can propose as many screening as they think there is demand for. A screening which was proposed but which failed to reach its ticket threshold does not cost the distributor / filmmaker anything.

- A minimum guarantee (MG) for the distributor / filmmaker, if the screening goes ahead. Typically up to £200 per screening.

- 30% of the income, after all the MGs and hard costs of running the screening have been repaid, there are normally three MGs to be repaid (the cinema, the distributor / filmmaker and ourscreen) and the hard costs could include the virtual print fee (VPF), payment handling charges and shipping costs for the DCP.

Let’s work through a hypothetical example:

- The distributor / filmmaker MG is set at £120 and once we include the other MGS and hard costs, the total is £400.

- The screen has a capacity of 100 seats and tickets cost £10 each.

- That means that the threshold they need to reach is 40 tickets. When they reach 40 tickets sold, then everyone will know they’re getting their MG and the screening is going ahead.

- If the screen sells out then the total box office is £1,000. The distributor / filmmaker is entitled to their MG (£120) plus 30% of the net sales (£1,000 £400 = £600 * 30% = £180), meaning they receive £300 for that screening.

This simplified example ignores elements like VAT but gives you a picture of the recoupment waterfall.

Who does this new future of cinema exhibition help most?

I think it’s fair to say that we are in the early days of audience-led screenings. ourscreen has grown quickly and look like they will continue doing well, but they are just one part in the new reality where distributors and exhibitors have to work harder to get people to attend the cinema.

I think it’s fair to say that we are in the early days of audience-led screenings. ourscreen has grown quickly and look like they will continue doing well, but they are just one part in the new reality where distributors and exhibitors have to work harder to get people to attend the cinema.

Other activities include alternative content (such as screening recordings of theatre, ballet and opera), live events (such as beaming live footage from a movie’s premiere ahead of its first screening) and experiential events (such as Secret Cinema’s blend of movie screening and interactive theatre).

These new options are of most value to smaller, independent filmmakers who do not have the power to demand traditional screenings from cinemas but who are willing to work harder to promote each screening they secure.

Power to the people!

Epilogue

I’m very grateful to Ian Cartwright who first introduced me to the lovely folk at ourscreen, and to Philippine and the ourscreen team for their data and for answering my constant questions. For the record, they gave me nothing other than data and pleasant emails; I don’t do any form of promoted posts or advertorials on this site.

A large amount of the data relating to ourscreen directly came from them, so I can’t personally verify it. That being said, it all makes sense to me and I have no reason to think that they aren’t being completely open and honest.

Comments

Scanned through it, Fab as usual! Will read in-depth asap.

Thanks for the consistent invaluable work Stephen. So helpful. Happy Holidays!

-Jan L.