What are the highest grossing UK low-budget films?

I spent the weekend at the first of twelve sessions for the Micro-Budget Mentor scheme that I'm running with producer James Cotton. We had a lecture theatre full of keen micro-budget filmmakers and I spoke about at the current state of low and micro-budget filmmaking in the UK. In order to prepare, I looked in detail at all the data I could find on UK low-budget films (i.e budgeted under £1 million).

The core of today's blog article is the combination of data I purchased from Rentrak, new data the BFI gave to me and a series of public online sources (such as IMDb, Box Office Mojo, Opus, Rotten Tomatoes, Metacrtic and Wikipedia). Consequently, I can't share all of the figures as freely as I normally would. Rentrak won't let me republish their raw data and the BFI have provided some data for background research only. Nonetheless, I feel that the key outcomes I am publishing today are new and noteworthy. I have never before seen a box office chart for low-budget films. In summary...

The UK film with highest global gross (under £1m, Jan 2008 to Aug 2014) was Searching For Sugarman.

Between January 2008 and August 2014, there were 1,419 films made in the UK budgeted under £1 million

Only 7 of these grossed over £1 million in cinemas worldwide

0.17% of the 1,190 UK films made on under £500k grossed over £1 million worldwide.

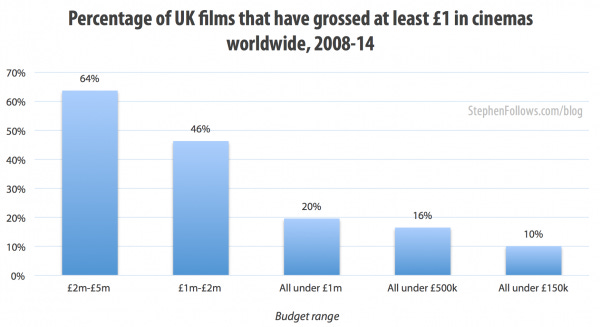

20% of UK films budgeted under £1 million grossed at least £1 in any cinema around the world.

That figure drops to 16% for films under £500k and 10% for films budgeted under £150k.

Rotten Tomatoes provides data on just 24% of UK films budgeted under £500k and Metacritic only rated 4% of the same group.

Highest grossing UK low-budget films (i.e. budgeted under £1m)

The UK film with highest global box office gross released between January 2008 and August 2014 was Searching For Sugarman. This film alone accounts for almost 24% of the combined gross of the top 50 films. [table id=24 /]

Highest grossing UK films budgeted under £500k

If we reduce the focus to just low-budget films costing under £500k then we see a whole new set of films rise to the top of the chart of global box office gross. [table id=25 /]

Grossing over £1 million

Between January 2008 and August 2014, there were 1,419 low-budget films made in the UK budgeted under £1 million and yet just seven of them grossed over £1 million in cinemas worldwide. They were (in order)...

Searching for Sugar Man

Marley

Locke

Anuvahood

Still Life

Redirected

Weekend

Two of those low-budget films (Marley and Weekend) cost under £500k, while the other five cost between £500k and £1 million. During this period there were 1,190 films made on under £500k in the UK, meaning that only 0.17% grossed over £1 million worldwide.

Grossing over £1

Only one in five of the films made in the UK between January 2008 and August 2014 on under £1 million grossed at least £1 in any cinema around the world. That figure drops to just 16% for films budgeted under £500k and 10% for films budgeted under £150k.

Bigger is better

The top 50 grossing sub-£1 million films list is dominated by films in the largest of the three budget brackets, namely '£500k - £1 million'.

Do high quality films gross more money than low quality films?

I took a look at the ratings given by critics and audiences via both Metacritic and Rotten Tomatoes of low and micro-budget films. The Rotten Tomatoes' Tomatometer measures the number of critics who gave a film a positive review and the Metacritic score is the average of the film critics' ratings. As you might expect, on average the critics' and audiences' ratings for films in the Top 50 grossing films within the low and micro-budget film category are higher than the average for other films within the category. However, I don't feel that the difference is large enough to claim 'proof' that quality films rule at the box office.

It should be noted that not many low budget films receive attention from Metacritic or Rotten Tomatoes. Rotten Tomatoes provides data on just 24% of UK films budgeted under £500k and Metacritic only rated 4% of the same group. Normally I use IMDb's audience ratings but I found that many of the films had such a small number of votes that the views of the filmmakers' friends and family were polluting the true measure of a film's quality.

So which low-budget films made a profit?

That, sadly, is a difficult question. The numbers here are just the grosses, meaning literally the total amount of money collected from cinema tickets. Out of this money a number of things need to be deducted, including tax (inc VAT), the cinemas' share, marketing costs, the distributors' share, sales costs, the sales agent's fee and then the investors. On the plus side, there are a number of other revenue streams (such as television, DVD, VOD, etc), many of which generate a higher return than cinema. The BFI use a rough rule of thumb to estimate profitability: if a film has made twice its budget at the global cinema box office then they regard it as likely to have made a profit. By this measure, only 7% of micro- and low-budget British films make a profit. However my personal opinion is that this rule falls apart for cheaper films because cinema is a much smaller part of the distribution plan and because most films benefit from healthy tax schemes, such as SEIS, which can provide investors with over half of their money back even before the shoot.

Caveats and Notes

Due to the nature of film data, especially at this low budget range, it is hard to be complete and 100% precise. Therefore, please consider the following points when reading and applying today's findings...

Still on release - Some of the low-budget films in my Top 50 were still on release when I bought data from Rentrak (end of August 2004).

Tracking films made - It may be the case that there have been more films made over the period stated and they are yet to appear on our radar. This is especially the case with low budget productions as many will not become known to official bodies until their British certification or tax credit applications are submitted. This typically happens within six months of a film's completion, meaning that there could have been films shot at the start of 2014 that are not yet being tracked.

Inflation - I have not adjusted for inflation.

Genres - I have assigned up to three genres per film.

Gross - Unless otherwise stated, all grosses are the total amount of revenue generated by that film in all the cinemas around the world, for which we have data.

Non-reporting territories - Rentrak does not track data for every territory in which a film is released. For example, in my 'Top 50' for low-budget films under £1 million, the films were released in a combined total of 350 territories (and average of 7 per film) and yet Rentrak only have box office gross data for a combined total of 246 territories (4.9 per film). That said, the missing territories are much smaller territories , the grosses of which are unlikely to massively affect the trends.

Arbitrary nature of budget ranges - The only official data I have about a film's budget is the 'budget range' given to me by the BFI. These are arbitrary cut-offs and so are somewhat crude grouping. For example, a film costing £1,000,001 will not appear on my charts whereas a film costing £999,999 will. Without the actually budget figures I cannot drill deeper.

Data sources - Today's data came from a variety of sources. I purchased box office data on all UK films from Rentrak. The BFI have provided vital tracking data, and budget ranges based on HMRC data. The critics and audience scores came from Metacritic and Rotten Tomatoes. Finally, I used IMDb and Box Office Mojo for verification and clarification.

If you notice something within these figures which you know to be false then please do let me know. I don't have the resources of organisations like the BFI (it's just me!) and studying low and micro budget films feels a little like stepping into the unknown. Consequently, I welcome any feedback or new information that can strengthen this data.

Epilogue

This topic is a frustrating one as I would love to get access to more and better data. The BFI keep back some of the numbers they have as it comes from a very private source (HMRC). This means that we only get budget ranges, not actual figures. The Rentrak data is useful but not complete as the task of tracking every penny spent in every cinema every day all over the world is nigh on impossible. Box office tracking services are designed mainly for tracking larger films, which make more of splash than micro and low-budget films (and therefore are easier to track) and for which there is a stronger commercial value (not many people offer money to buy micro-budget film data). Finally, the key pieces of the puzzle that everybody wants, i.e. profitability data, are hidden behind a wall of privacy and complex distribution/ recoupment chains.