Can cinemas survive the next 20 years? Exhibition execs on the post-COVID recovery and beyond

Cinema operators and industry insiders reflect on the state of theatrical recovery, revealing cost-cutting, programming shifts, and ongoing uncertainty about the future.

This is part two of my collaboration with Screendollars in which we spoke to 246 cinema owners and film professionals affiliated with exhibitors. We quizzed them on a range of topics, and their answers were very revealing.

You can read part one here - The five biggest concerns facing US cinema exhibitors today.

Today’s article looks at how professionals in and around exhibition perceive the state of the industry today. What shape is the recovery taking? How long do insiders believe the theatrical model will last? And which operational or strategic changes are helping cinemas stay afloat?

Among the things we learn today:

Most cinemas have not fully recovered since COVID.

Cutting costs and flexible programming proved to be the most effective survival tactics.

Around half of those who work in exhibition feel that the cinema business has less than 20 years left.

A strong majority still believe in the value of an exclusive theatrical window.

Day-and-date remains deeply divisive across different parts of the industry.

The long road to recovery

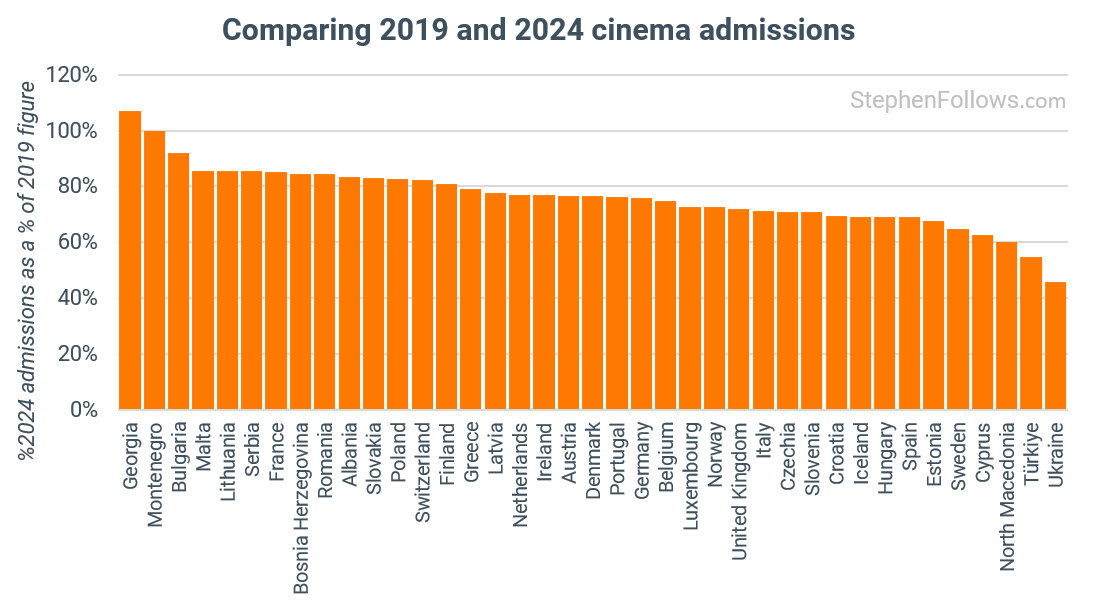

Five years after the pandemic forced a total shutdown of cinemas, the exhibition sector is still navigating a fragile recovery. Audiences have returned, but not in full force. Last week I covered the international view, showing that cinema admissions in 2024 were down on 2019 in almost every country.

Today’s interviewees all work in the Domestic sector (i.e. US and Canada) which has experienced a 75.4% recovery over the same period, from $11.36bn in 2019 to $8.56bn in 2024.

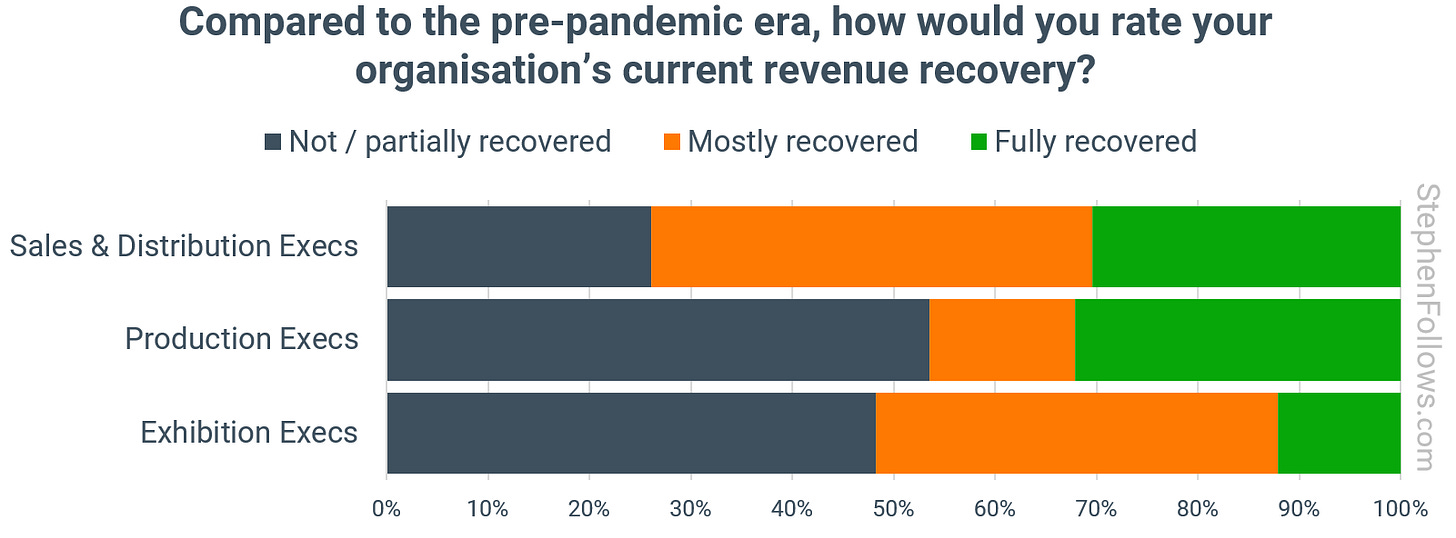

Only one in eight of exhibition executives we spoke to said that their business had fully recovered to pre-pandemic levels, compared to a third of production execs.

What helped cinemas recover?

We asked them what had helped the most in this recovery, and the answers reveal an interest divide.

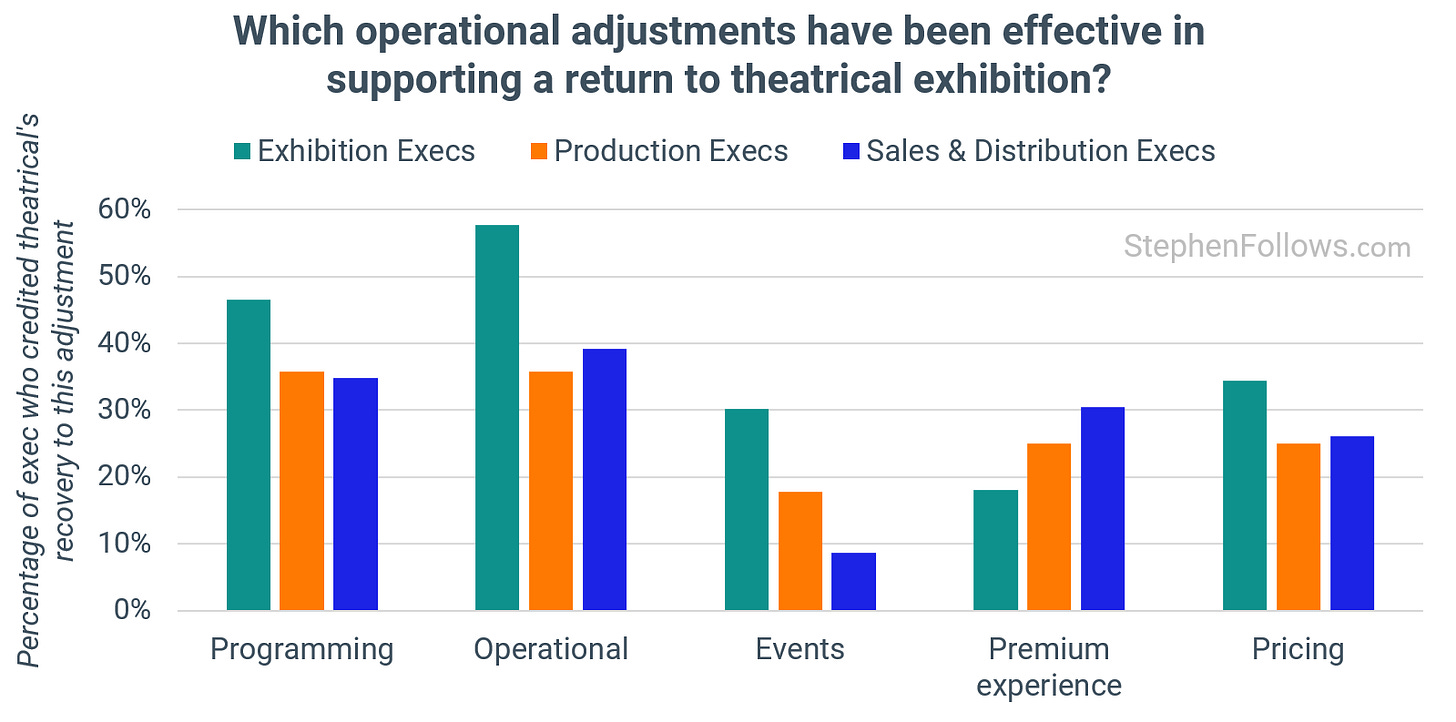

For those closest to the coal face (i.e. those actually operating cinemas) the top-ranked adjustment was reducing staffing and operational costs. 57.8% of exhibition executives said this had supported their recovery. Programming changes also performed well, with 46.6% citing flexible scheduling and dynamic calendars as an effective tactic.

Exhibition execs also credited event cinema (more on cinema events here), whereas few of who do not directly operate cinemas were much more likely to credit cinemas offer premium experiences.

This matches a wider pattern I have spotted in the industry, whereby those who interact with real audiences on a regular basis have a better idea of what people actually want. Not a ground breaking thought but it does highlight how disconnected many key roles in the film business can be from real world film consumers.

What is the future of the cinema business?

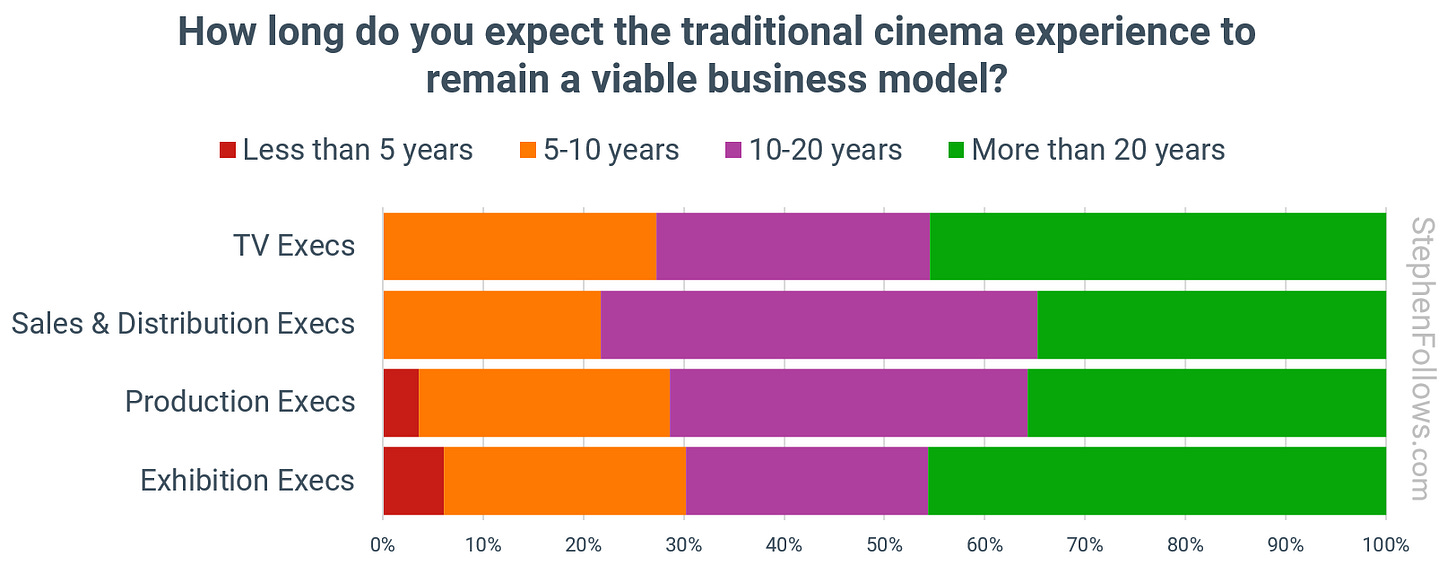

When asked how long the cinema business has left, we see a split between two camps.

Exhibition exces were the mostly likely to say “More than 20 years” (45.7%) and the most likely to predict “Under five years” (6.0%).

Just under half of those who work in exhibition feel that the business has less than 20 years left to run.

The picture is similarly divided among other sectors. The most pessimistic are those working in sales and distribution, where two-thirds expect the traditional model to last no more than 20 years.

There are a couple of things to keep in mind here.

Firstly, this captures peoples’ points of view and levels of optimism - it’s not an economic study or prediction.

Secondly, it could be that the “traditional cinema experience” evolves and changes with the times, meaning that the people, companies, and locations survive but in a different form. Next week’s article will touch on how new audiences are changing the nature of cinema going.

The window still matters

If there is one topic that consistently stirs up strong views in exhibition, it is the theatrical window. For years, release windows have been getting shorter and many execs cite this as one of the root causes of the sector’s fragility.