Change in the film industry is often an extremely gradual process. The views of those involved tend to be entrenched and hard to shift. Therefore, how the film industry will operate one year can reasonably be expected to be very close to that of the year before.

Not so 2020. The current COVID-19 pandemic has forced a number of huge changes upon the sector over a matter of days. Cinemas are shut, productions are on hiatus and almost everyone is at home watching TV and VOD content.

In order to take the industry’s temperature at these uncertain times, I teamed up with Screendollars to interview 363 film professionals. We focused on the domestic market (i.e. USA and Canada) and asked a range of questions about their views on the current changes and what they think a post-lockdown future may bring.

We split respondents into five groups, based on their area of professional work:

Filmmakers, covering development, production and post-production.

Sales & Distribution, including sales agents, distributors and marketers.

Exhibition, cinema owners and operators.

Home Ent, TV & VOD, including physical and digital sales, all forms of VOD and films on television.

Other, including those in education, government bodies, festivals, journalism, cinema suppliers and more.

Mood of the industry

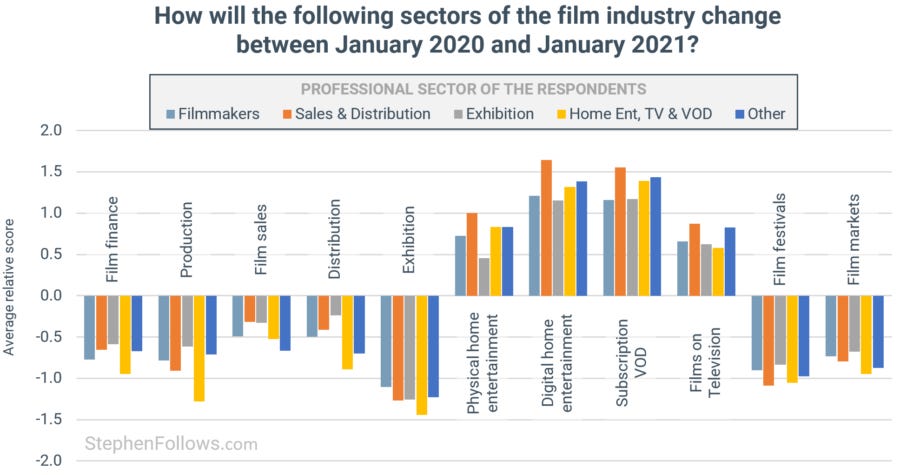

The vast majority of respondents agreed that COVID-19 has negatively affected all aspects of the film industry which take place outside of people’s homes. Furthermore, there is a cross-industry consensus that the exhibition sector has been the hardest hit by the pandemic.

The chart below shows the perceived impact of the pandemic on each sector of the industry. An average score of zero would show that the respondents felt there would be no change between January 2020 and January 2021 for the sector in question. Therefore, a negative score reflects a perception that things will be worse, and a positive score reflects a better future.

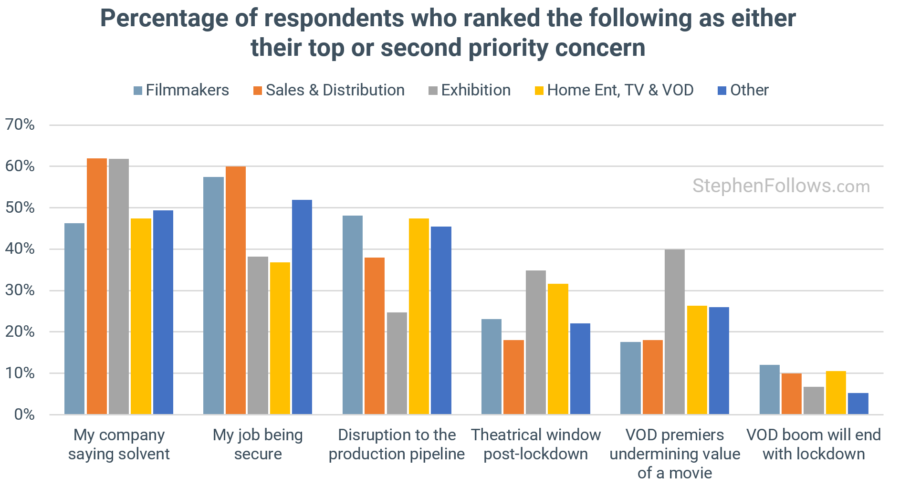

Despite most agreeing that the long-term will be kind to the people supplying movies to consumers’ homes, those involved are still worried about their current positions. Almost half of the people working in Home Entertainment say that the solvency of their employer is their top or second concern.

Breaking windows

Perhaps the most consequential changes to the industry are being felt in the exhibition sector. Over the past decade, cinemas and studios have fought a slow battle over the amount of time a new movie should be exclusively available in cinemas (known as the theatrical window), which currently sits at 90 days.

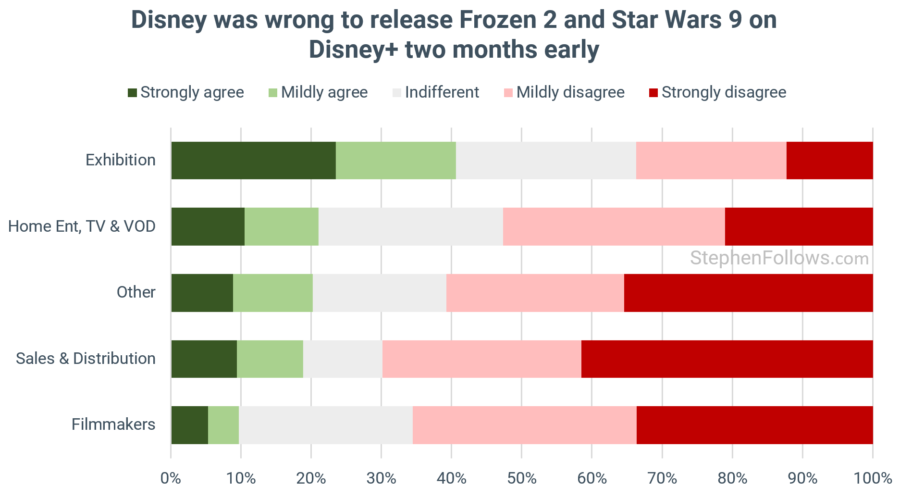

Despite this, the pandemic has seen a number of releases break the window detente. Disney brought Frozen 2 and Star Wars to digital platforms sooner than expected and Universal eschewed the traditional theatrical release for Trolls World Party altogether.

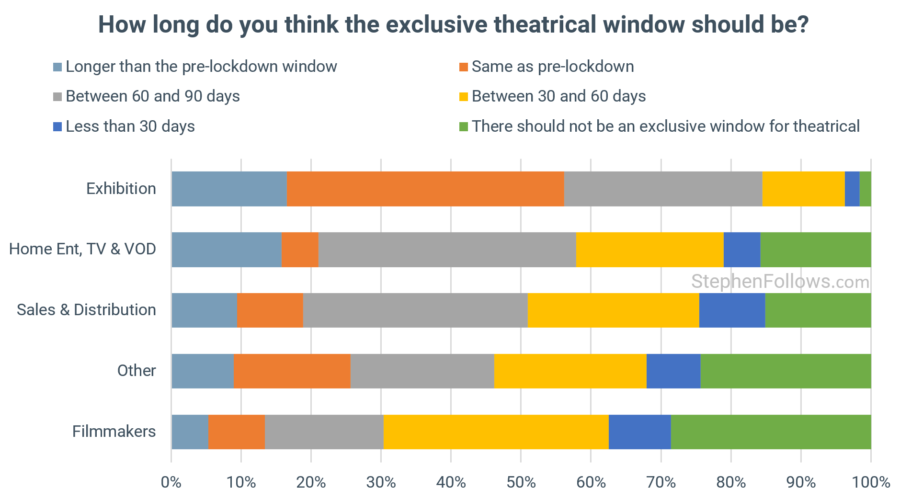

The research reveals a deep divide between the makers of movies and those who screen them in cinemas. Only 30% of filmmakers think the theatrical window should be longer than 60 days, compared with 84% of those in exhibition.

Only a third of people working in Exhibition agree with Disney's decision to release Frozen 2 and Star Wars early on their SVOD platform, Disney+. This is far fewer than those in Sales and Distribution (70% of whom agree) and filmmakers 66%).

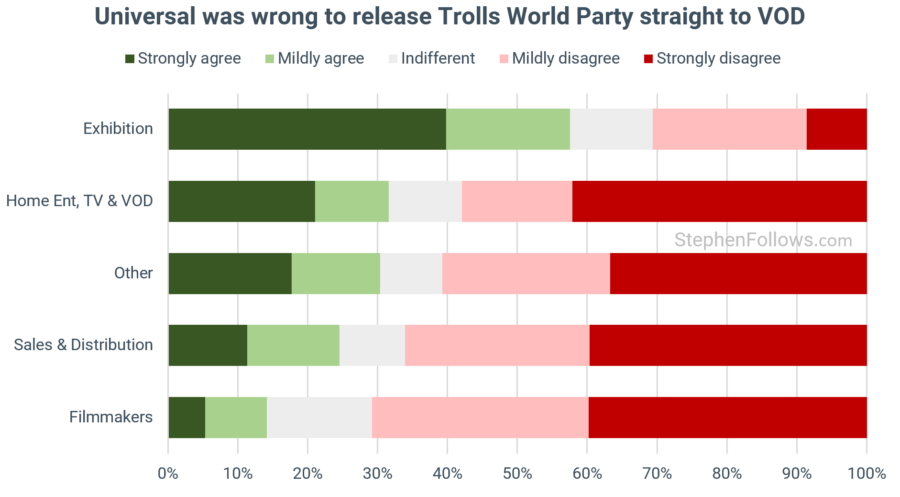

A similar pattern is seen in relation to Trolls World Party, with just 14% of filmmakers thinking Universal made a misstep with their VOD premiere compared with 58% of those in exhibition.

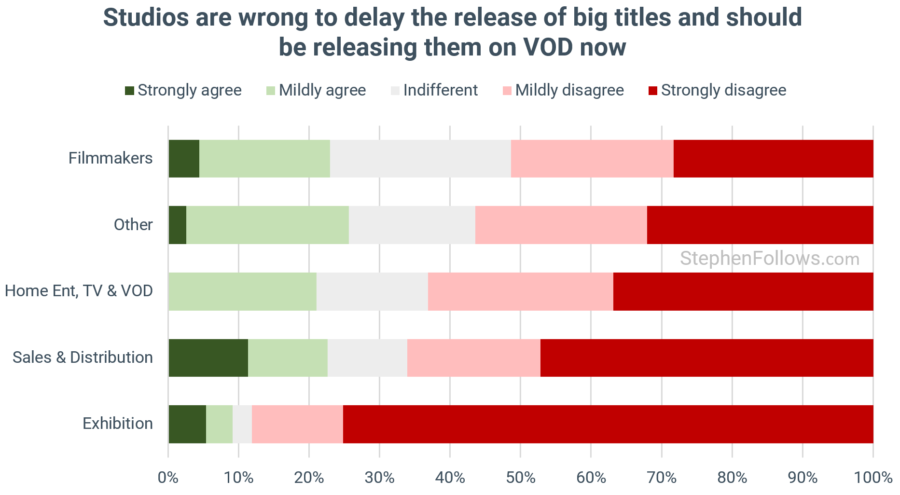

Despite these specific examples, it’s interesting to note that half of the filmmakers don’t think studios should be skipping theatrical releases for their upcoming titles, with only a quarter of filmmakers actively supporting a VOD-first approach.

Unsurprisingly, the folks in Exhibition are still very much pro studios releasing films in their cinemas first, with fewer than one in ten supporting the studios’ VOD release strategy.

Expectations of the post-lockdown future

Respondents working in the exhibition sector were the most optimistic about a speedy return to pre-lockdown levels of cinema attendance. 58% felt that things would be back to “normal” within a few months. There were also the least likely to believe that cinema attendance will never return to pre-pandemic levels.

The reverse is true of those working in Home Entertainment, with two-thirds believing cinema-going won’t regain its former glory within a year, if ever.

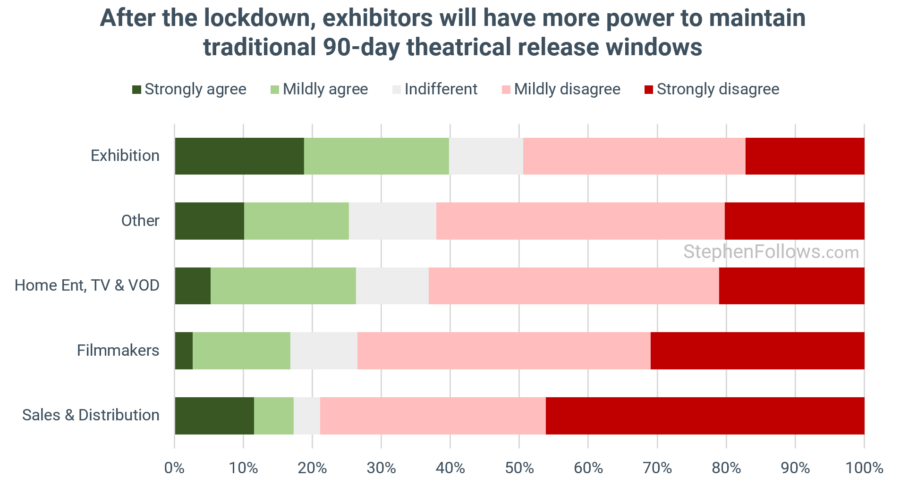

Exhibitors seem more bullish about their ability to protect exclusive windows than their peers in sales and distribution.

Solutions to aid recovery

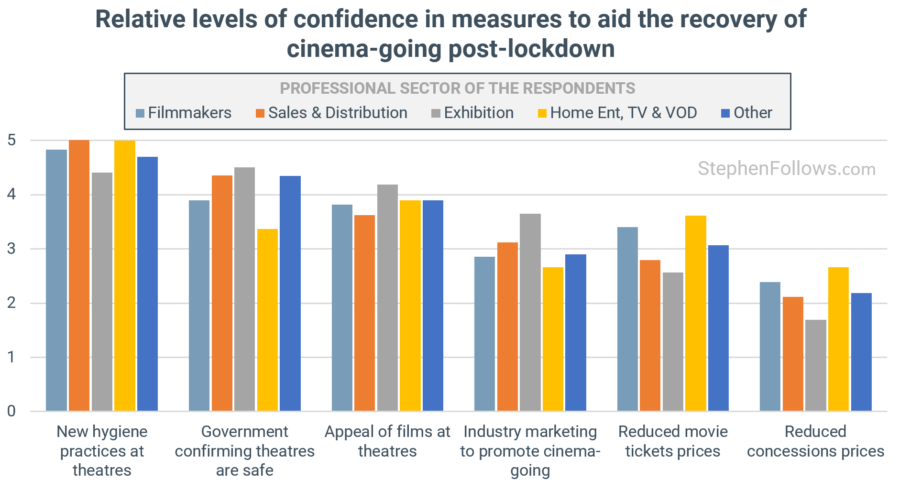

When quizzed on the merit of a number of possible actions to support post-lockdown cinema attendance, most agreed that price was not the defining factor.

The most popular measure overall was new hygiene and sanitation practices in cinemas, closely followed by a desire for government communications to declare cinemas to be safe.

The future

Perhaps the hardest thing to predict at the moment are the long-term effects of the pandemic. On the one hand, audiences have become more accustomed to paying more for VOD-first content and it may take a long time for them to feel safe spending a few hours in crowded public spaces. On the other, being cooped up inside may further highlight the appeal of the big screen and movie-going provides a (relatively) inexpensive social experience.

No matter how audiences respond, the biggest changes caused by the pandmeic are likely to be the ones taking place away from public view. The finely balanced power dynamics of releasing have been destroyed and the outcome is as-yet-uncertain. Studios may feel emboldened to further shorten theatrical windows and loss of months of income could harm some exhibitors’ ability to invest or even continue operating.

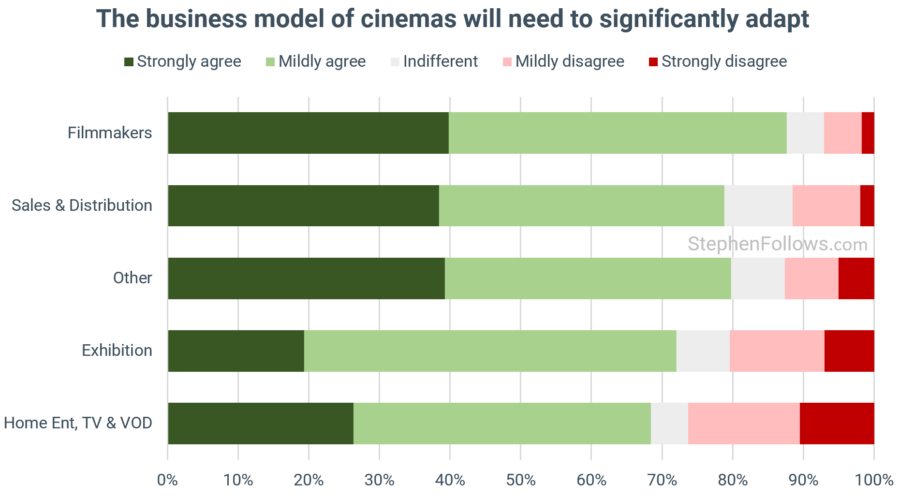

Perhaps the most surprising result from the survey is that all sectors in the industry recognise the need for change. Two-thirds of respondents in Exhibition agree than some change will be needed in the business model of cinemas.

What that change will be… is less clear.

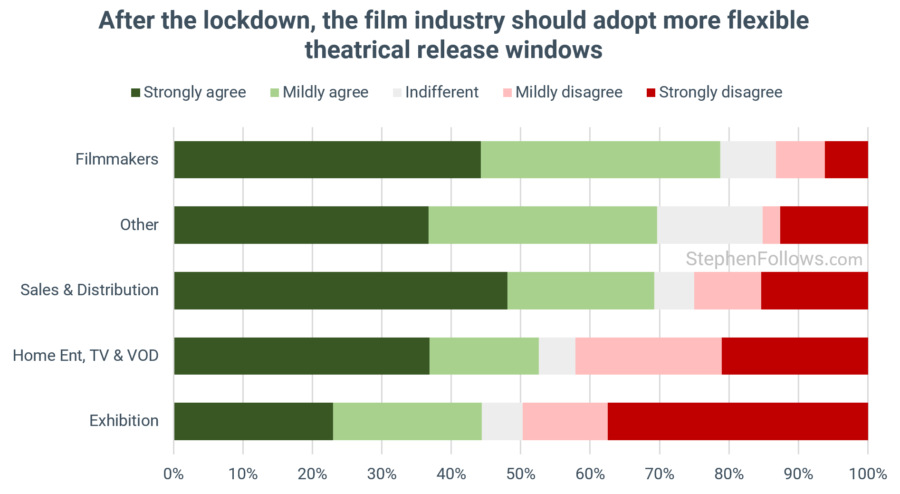

Despite the broad agreement that change is needed, the two ideas we tested provided a return to the polarisation we saw in earlier questions, with Filmmakers strongly in favour of change but with Exhibition folks much more resistant.

Half of the exhibition cohort thought that flexible release windows should not be adopted, compared with just 13% of filmmakers.

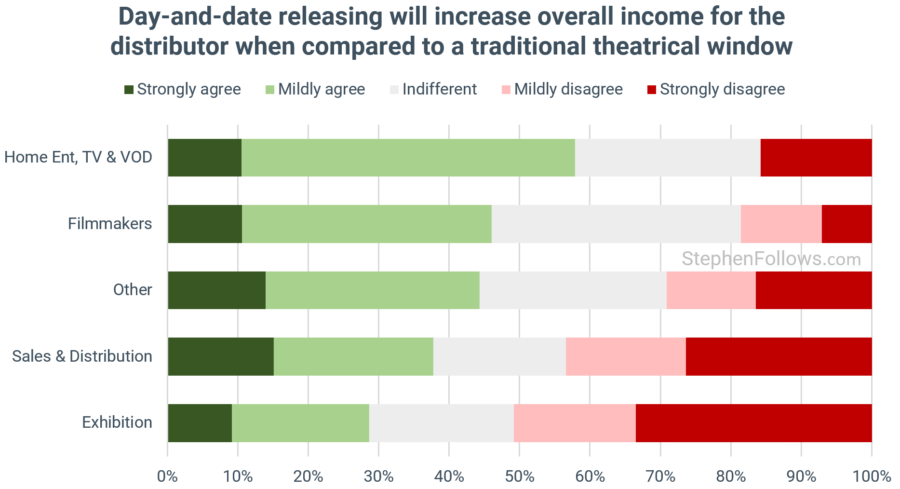

Finally, we asked if a day-and-date release (i.e. simultaneous release in cinemas and on digital platforms) would provide a greater overall income than the traditional window release pattern. As one would expect, those in home entertainment thought it would while those in exhibition thought not.

However, the key group here are those in sales and distribution, as they see the complete value chain and are seeking to maximise revenue across all platforms. In this case, they broadly agreed with the exhibitors, implying that perhaps we are not on the cusp of a day-and-date revolution quite yet.

Notes

This survey was conducted between 4th and 14th May 2020. Respondents were self-selecting and we cannot know to what extent their views are shared by others.

We focused on the domestic market as 94.5% of our survey respondents were based in the United States or Canada. 58% of respondents were at senior or top positions in their companies and 81% expect to be still working in the industry in five years’ time