How concentrated is agency power among top movie actors?

I gathered data on 2,000 of the most famous actors to track just how concentrated agency power is.

Film is defined by being an industry of outliers, shaped by power laws where success and influence are concentrated in the hands of a few.

And this is never more true than among Hollywood agents.

I wanted to check in with the situation as it is today. Which agencies represent the greatest number of high-profile actors?

Which Hollywood agencies represent the biggest actors?

In most cases, when actors talk about "my agent", they mean the person who helps them find work, negotiates deals, and manages the business side of their acting career.

Those agents work for “an agency”, which might be just them or anywhere up to a massive corporation. According to LeadIQ, WME employs around 5,000 people, CAA has 4,400 employees, and UTA 2,300.

Today I’m looking at agencies, not individual agents (research for another time, maybe!).

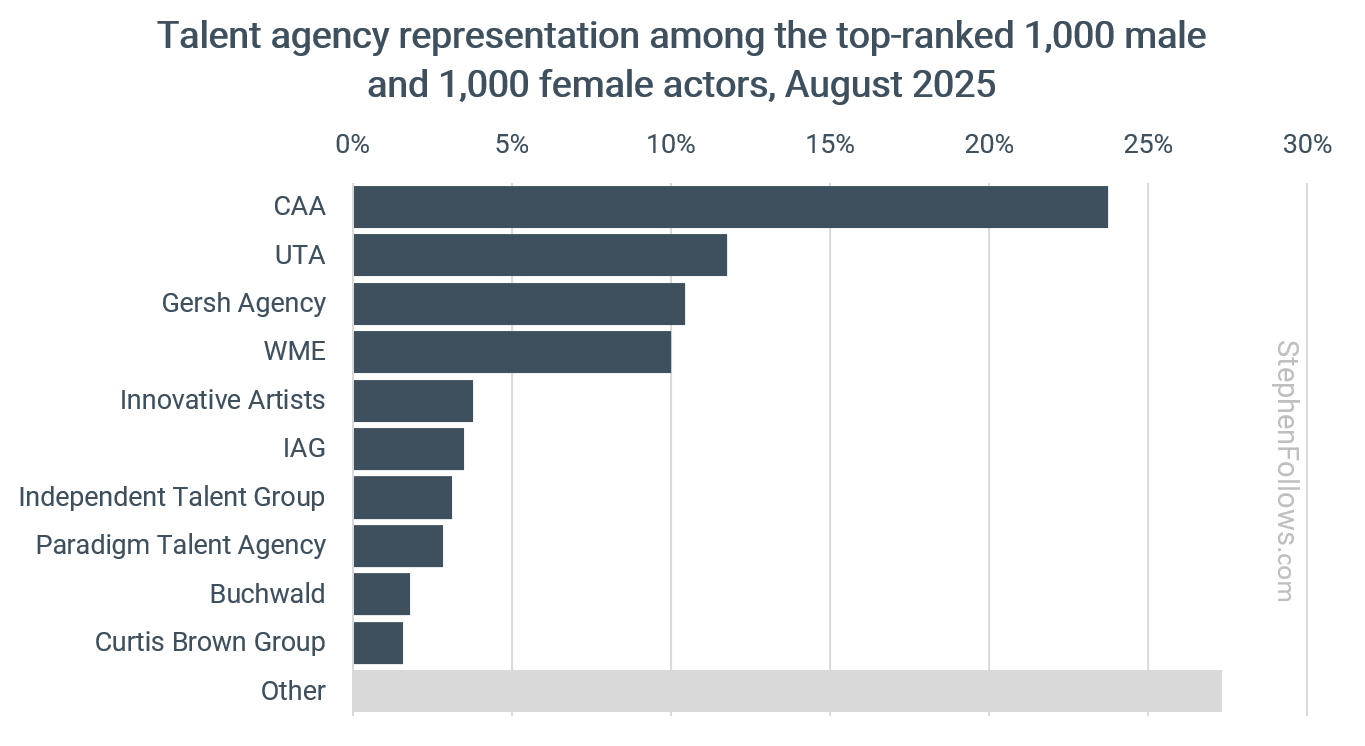

To get a sense of overall agency dominance, I researched the top 1,000 male actors and top 1,000 female actors on IMDb’s STARmeter in August 2025. There’s more detail on methodology in the Notes section at the end.

The chart below shows which agencies are credited with representing the largest share of these 2,000 actors.

Creative Artists Agency (CAA) is out in front, representing 23.7% of top actors who publicly list their agency. They are followed by United Talent Agency (UTA) at 11.8%, Gersh at 10.4%, and William Morris Endeavor (WME) on 10.0%.

So although I tracked 156 agencies across the dataset, 56.0% of the market share went to just four companies.

Some agencies prioritise the most famous actors

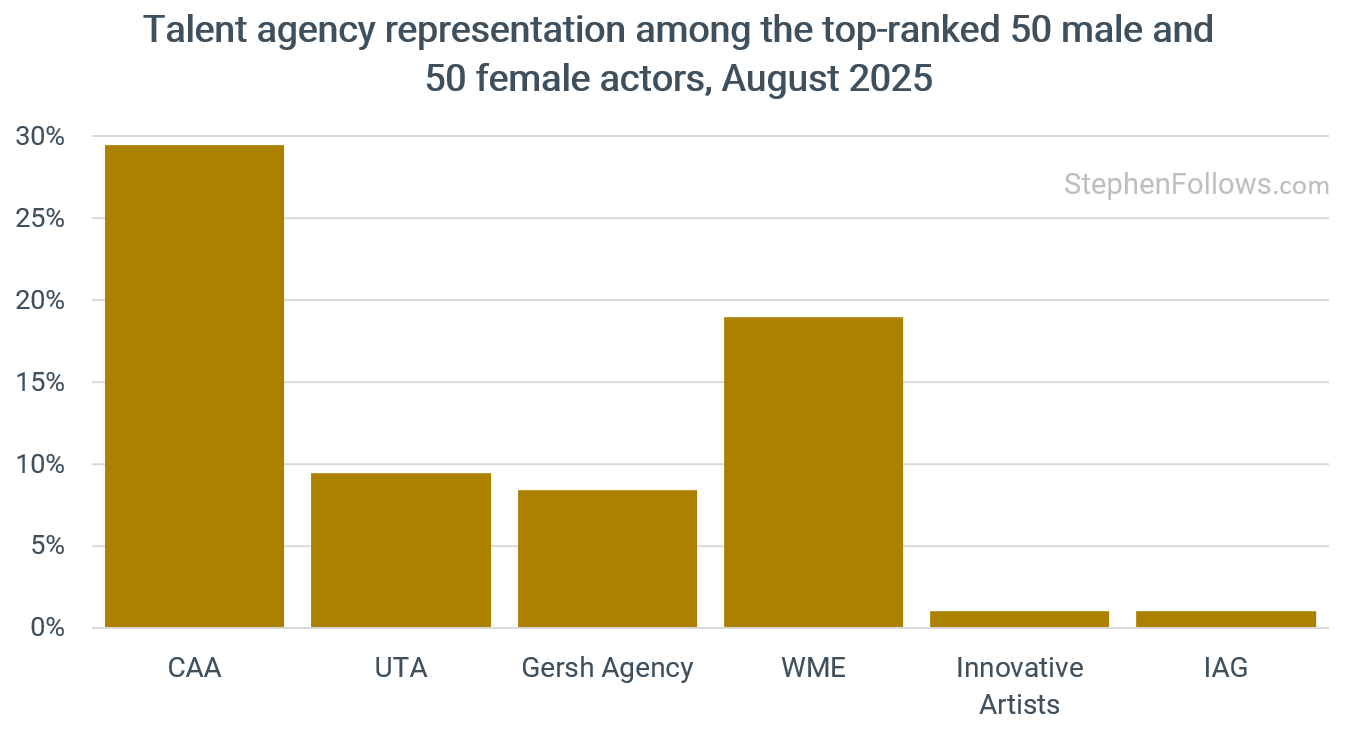

If you regularly read the film trade press then you may be surprised to see WME in fourth place, given that it’s often regarded as part of the “Big Three”.

This is, in part, a consequence of my decision to look at the top 2,000 actors. If we narrow it down to the top 100 (i.e. the 50 most famous male actors and the 50 most famous female actors), then the triumvirate is restored.

This reveals something interesting about the differing business strategies of each agency (well, the strategies that the market and their wallets will allow them to execute).

Some agencies seem to prioritise elite visibility, while others focus more on volume or emerging talent.

We can see this in action when we split each agency’s share across broader tiers: Top 50, Top 100, Top 250, Top 500, and Top 1,000 actors.