How MoviePass could revolutionise the cinema business

The film business has changed more in the past few decades than in any time since its inception. Technological innovations have massively affected almost every area of the film lifecycle, including:

Pre-production. Computer-based scheduling, email communication with cast and crew, virtual casting tapes / Skype casting, mobile phones on set, etc.

Production. Digital cameras have made it cheaper and easier to shoot, watch back rushes, test digital effects on-set, etc.

Post-production. Probably the biggest area of technical change. Most of us will think about the boom in Visual Effects but there have been big changes behind the scenes, too. Computer-based editing has shrunk the cost and scale of picture editing, allowing for greater collaboration between people (either in the same location or apart) and giving editors more freedom (to save differing edit versions, instantly undo edits, etc).

Sales and distribution: Email and password-protected video sharing make it much easier to show off a film outside of a film market and digital distribution allows for massive simultaneous releases around the world.

Marketing. Movie marketing campaigns can be truly global and social media allows for the buzz in one territory to spill over to another.

Home entertainment. The power has shifted from the producers of movies to the consumers of movies, with so many options of when and how to watch movies (both legally and illegally).

But there has been one sector whose last major change took place many decades ago - Exhibition. The principles of the exhibition business are simple - screen movies, charge entry and (hopefully) sell your patrons a load of massively marked-up food and drink on their way to the screen. I've heard it described as "Renting seats and selling sugar".

Over the past hundred or so years, there have only been a few changes to the cinema business.

What's the offer? The nature of a screening has changed over the years, from early novelty films to whole programs (including newsreels, shorts, B movies, etc) to what we expect today (adverts, trailers and a feature-length movie).

What's the experience like? Cinemas have played around with different aspect ratios, 2D vs 3D, IMAX, digital, 4K - all to lure us away from rival cinemas and, sometimes, to charge us more for the ticket.

What's showing? The last major innovation was the multiplex, allowing for a far greater number of movies to be shown (or to have Fifty Shades Freed starting at staggered times throughout the day).

One thing that hasn't changed for the vast majority of cinema-goers is how they see buying a cinema ticket. Sure, they can now buy them online, but the principle is the same - when I want a cinema ticket, I buy one. It's a demand-led, single-use purchase. Some European chains have subscription-based offerings but they remain on the margins and are restricted to whichever chain is offering them.

This could be all about to change.

Maybe. Or maybe not. Who knows? No-one, that's who.

The reason for my equivocation is that right now there is a major experiment going on in the US cinema industry that is likely to have profound effects on the exhibition sector worldwide. A bold start-up is currently revolutionising the way consumers buy cinemas tickets in the US and doing so despite facing some major barriers, not least operating without the support of cinema chains and ignoring basic economics.

The company is called MoviePass and their pitch is simple - a subscription-based service which allows you to see an unlimited number of 2D movies in cinemas for a single monthly price of around $10. Let's take a quick glance at this service to understand a little more about what it could mean for the cinema sector.

MoviePass 101

MoviePass has had a number of different guises over the past few years (more info below) but the simplest way of describing it is to talk through the current customer journey: For a fixed monthly fee, users can watch as many 2D movies as they want in standard US cinemas.

Upon joining, they are sent a special MoviePass debit card and access to the MoviePass app. If they want to see a movie they just show up at the cinema on the day of the screening, open the app and select the screening. Their special debit card is then loaded with the exact amount of money the cinema ticket costs and they buy it from staff as they normally would.

On the one hand, this is a fairly predictable move. The success of services like Netflix and Amazon Prime have shown how willing consumers are to pay a subscription fee in return for "unlimited" access to content. So you could say that this is just the exhibition sector catching up. On the other hand, this is a bold and radical idea. It's a sector which is not used to change and it's being done against the expressed wishes of the cinemas in question.

The people behind MoviePass are not amateurs; they come from major companies in both the movie and tech worlds. Their CEO, Mitch Lowe, was a co-founder (and ex-Head of Business Development) of Netflix and also worked as COO at movie rental firm Redbox. MoviePass's COO, Stacy Spikes, was formerly a vice-president of Marketing at Focus films, Miramax and Columbia Records. Their principal investor (and Chairman of the Board) is Chris Kelly, who was previously Facebook's Head of Global Public Policy and is now a serial entrepreneur.

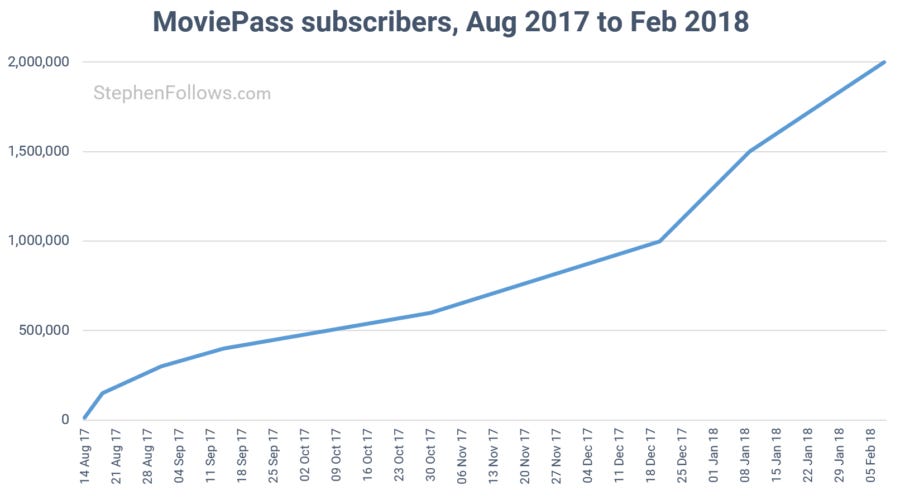

MoviePass' success has been rapid. Data is hard to come by as they're a private company, but based on the numbers they have published, the chart below shows their recent subscriber growth.

There is a lot to discuss with MoviePass but in an effort to keep it simple, here are the five things I think are important:

The market they're going after is massive

The cinemas are not happy

MoviePass is connecting to people that cinemas are struggling to reach

It's not as "unlimited" as it at first seems

MoviePass faces some huge obstacles ahead

I'll now go through each of them in a little more detail.

1. The market they're currently going after is massive

SEC filings by Moviepass reveal the scale of their ambitions. They quote MPAA figures in describing the US cinema market as having 36 million "avid" moviegoers and a further 246 million "causal" movie goers. This adds up to an annual US box office gross of over $11 billion.

As their CEO puts it: "With MoviePass, there’s no movie ticket prices to think about - going to the movies will become an everyday experience rather than an occasional treat".

They also point out that the US movie concession market (i.e. food and drink) is worth an additional $5- $7 billion each year. To date, they have only used this figure to make the case to cinemas how any MoviePass-led increase in cinema attendance doubly helps the cinema's bottom line, but I'm sure that if they win their current battle for control of admissions, they would start to eye up the concessions sector somehow.

MoviePass claims that their systems benefit all major players in the theatrical market, namely:

Consumers save money and take risks in seeing new movies they would not have wanted to pay full price for.

Exhibitors benefit from increased attendance (still earning their normal fees for each ticket sold) as well as the increase in food and drink sales from these new patrons.

Studios enjoy the increased cinema box office, manage their risk on poor movies (as consumers are more willing to check them out) and the MoviePass system could be used to market directly to consumers.

And it's that last point which is the holy grail of MoviePass's long-term success. It's all about the data.

Current movie marketing is hit-and-miss: expensive and wasteful. Only about 10% of the US population are classed as "avid" moviegoers and yet are the people studios rely on. In order to reach these people, marketers have to run broad campaigns via television adverts, outdoor posters and PR activities - all of which are wasted on most of the people who see them.

The problem is compounded when you have a niche movie which would appeal to a smaller subsection of the population and doesn't justify a massive marketing spend.

A further problem for movie marketers is that there is very little continuity in marketing across multiple movies. Disney knows that around 67 million people bought a ticket to see Star Wars: The Last Jedi but they don't know who those people are. So they can't reach out to those people in the future to sell them a tie-in, home version of the movie or to promote the next Star Wars instalment.

In theory, MoviePass could change that. Their consumer base is their principal product and they could sell access to the highest bidders. One only need look at what consumer data has done for Facebook to see the power of providing marketers with highly-targeted advertising options.

2. The cinemas are not happy

You could take the view that the cinemas should be happy with this new innovation. It costs them nothing, drives new full-price ticket sales and herds more hungry/thirty people past their overpriced concession counters.

But it's not the short-term that worries the cinema chains, it's what this means in the long-term. A successful and powerful MoviePass could cause trouble for cinemas in a number of ways:

Monopoly power could lead to pressure on ticket prices. Barring small changes in layout and technology, most modern multiplex cinemas are indistinguishable from one another. This means that MoviePass users are likely to show little resistance if the company decides to stop supporting one particular site or chain. This could give MoviePass enormous power to drive large numbers of consumers to, or away from, certain cinemas. Cinemas may become powerless to resist MoviePass's demands for cheaper tickets. For an example of what could happen, one need only chat to farmers who supply mega supermarket chains.

Muscling in on the concession market. This hypothetically-powerful MoviePass could also start demanding a cut of concession income. Investor documents by MoviePass make reference to "VIP Line for concessions", suggesting that MoviePass would put pressure on cinemas to provide a different level of service for MoviePass users.

It would stifle the cinemas' own subscription-based offerings. If MoviePass is right that consumers are crying out for 'the Netflix of cinema-going' then their early dominant market position could be used to prevent any cinema from setting up their own service in the future. Plus MoviePass have a patent on their system, further inhibiting the ability of rivals to challenge their dominance in the future (as has just happened this week).

The perceived value of a cinema ticket. Anyone who used to buy lots of DVDs and who now watches a lot of Netflix can attest to how their impression of the value of a movie has shifted. When you have a subscription service offering more movies than you can possibly watch, then it's harder to justify paying £15 for a single brand new disc or download. This could happen in cinemas, and even if MoviePass doesn't survive, it could have a lasting effect on the sector.

Despite their objections, there doesn't seem to be much the cinema chains can do to prevent consumers using MoviePass. When MoviePass dropped their prices to $9.95 last summer, AMC said:

We are actively working now to determine whether it may be feasible to opt out and not participate in this shaky and unsustainable program... AMC believes that holding out to consumers that first-run movies can be watched in theaters at great quantities for a monthly price of $9.95 isn't doing moviegoers any favors. That price is unsustainable and only sets up consumers for ultimate disappointment down the road.

In response, MoviePass CEO Mitch Lowe was unfazed:

We pay full price for the tickets we buy. We comply fully with the rules of MasterCard and AMC has signed agreements with both their credit card processor and with MasterCard to comply with all the rules. They would essentially have to not take MasterCard in order to block us. I don’t think you can cancel that agreement without severe penalties.

It seems that the only chance cinemas have to avoid an all-powerful MoviePass is to hope that the economics of their model forces a rethink before they become a sustainable business.

3. MoviePass is connecting with people who cinemas are struggling to reach

MoviePass appeals to a group of consumers who cinemas (and Hollywood studios) have been struggling to attract - millennials. In previous articles, I've shown how the cinema audience is ageing (here, here and here) and how the loss of young people is the biggest fear of many cinema owners.

About 75% of MoviePass' users are between 18 and 34 years old and their CEO was quoted as saying “Millennials understand us because they grew up on subscription".

The New York Times spoke to one such millennial MoviePass user who had previously visited the cinema for “maybe one movie a month” but who watched twelve movies in the month of November 2017, thanks to MoviePass. He said: "I used to only go if it was clearly worth buying a ticket — something big-screen worthy, a spectacle or a movie with a lot of effects. I would skip the undercard movies. I would just wait until they came out on Netflix".

So this is a double win for the cinemas and Hollywood - they have a way to connect with a hard-to-reach group, and they are better insulated against the poor performance of a bad movie.

4. It's not as "unlimited" as it at first seems

The sell of "unlimited movies" is very enticing but, as always in life, terms and conditions do apply. Among the factors holding you back from seeing whatever you want are:

It's only 2D movies. Many cinemas charge a premium for 3D and IMAX movies, so it's not a surprise that these movies are not included in a MoviePass subscription.

You can only buy your tickets on the day of the screening. This is more of a problem than it first seems, as it effectively precludes the use of MoviePass for any brand new or highly popular movie. In theory, you can use your MoviePass card to see the hot new tentpole on its day of release, but in practice, you're unlikely to find a cinema with seats for sale on the same day. Good seats to see highly anticipated movies in their first weekend of release almost always sell out far in advance, as disappointed Star Wars fans discovered last year.

Users are limited to one movie a day. Not a major drawback to most consumers but a restriction nonetheless.

Tickets are non-transferable. MoviePass users can't buy tickets for other people.

You have to be within 100 yards of the cinema in question, as the MoviePass app uses GPS location to permit use.

5. MoviePass faces some huge obstacles ahead

If MoviePass is to flourish, it will need to overcome (or continue to ignore) a number of pretty major problems, including:

Basic economics. The current plan costs the user $9.95 a month and allows them to see one movie a day. MoviePass is paying the cinema the full ticket price for each visit, currently an average of $8.84 in the US. Even if each of their users goes to the cinema just once a month, MoviePass is still likely to lose money, due to sales taxes, overheads and operational costs. A customer who uses their full quota would cause MoviePass to lose $3,107 a year (i.e. 365 movies at $8.84, minus the annual $119 subscription fee). This kind of heavy usage is unlikely in the real world, but it's easy to see how bad the downside is, with very little chance of an upside. MoviePass can't be relying on people paying and not using their service, as the majority of people will cancel after a few months of this.

Industry hostility. MoviePass has made little effort to get the cinemas on board. It seems as though they have concluded that their best chance of success is to grow as big as possible, as quickly as possible, and then it doesn't matter what your industry "partners" think of you. Just ask book publishers whether they like Amazon.

Scalability problems. The company's rapid growth has caused major issues with their ability to handle the additional business. There have been widespread complaints about crashing websites, buggy apps and failed transactions. MoviePass's CEO has admitted that the problems some customers faced have "definitely not been good for customers or our reputation".

MoviePass CEO Mitch Lowe is not fazed by his critics, and cites his experience in co-founding Netflix: "When we launched Netflix, Blockbuster said, ‘This is a ridiculous idea. You’re going to create confusion in the market. You’re never going to make it".

What's the positive case for MoviePass?

Morgan Stanley have said that they think about two-thirds of the current US movie-going population could eventually become MoviePass subscribers. And if MoviePass manage to reach 20 million users, Morgan Stanley predicts that the service would control 27% of all US cinema tickets sold.

In a sperate bit of analysis, Seeking Alpha predicted that if MoviePass reaches that 20 million subscriber milestone, then the company will be worth $10 billion. A new Netflix- or Amazon-style force for the movie world to learn to deal with.

The MoviePass timeline

As regular readers of the blog will know, I'm not one for brevity. And so, in that spirit, I have written an edited timeline of how MoviePass got to where it is today.

Feb 2011 - Raised $1.5 million in seed investment from 11 investors, including major Hollywood talent agency William Morris Endeavour (WME) and AOL Ventures.

June 2011 - Private beta of the MoviePass scheme and app is launched with 21 cinemas in San Francisco, offering a $50 unlimited monthly plan and a reduced $30 plan for up to four movies a month. 3D and IMAX movies incur a $3 surcharge per ticket.

July 2011 - AMC Theatres and other cinemas in the Bay Area object to MoviePass and the beta rollout is put on hold. AMC issue a press release quoting their head of marketing as saying: "Plans for this program were developed without AMC’s knowledge or input... We were surprised to see the press release and subsequent press coverage of MoviePass earlier this week as it included several of our San Francisco locations. It was news to us to see that we were participants and we will be communicating to those theaters they are not to accept MoviePass". In response, MoviePass said: "We absolutely want to work with the exhibitors directly. But we thought we needed a proof of concept before they would take a brand new company seriously ... MoviePass is not in the discount business. Nor are we setting ticket prices. In fact, we are paying full price for the tickets. Our MoviePass subscribers will benefit if they attend frequently…and so will the theaters when they purchase popcorn, soda and candy. We love movies and believe that MoviePass will be good for the movie business".

August 2011. MoviePass restarts the trial, thanks to a partnership with Hollywood Movie Money which allows users to print out vouchers at home to use the service. The initial beta was limited to just 21 sites in San Francisco whereas this new iteration works in over 36,000 screens across the US. As the printed vouchers give cinemas the full price of tickets and no way of knowing it was bought through MoviePass, they cannot initiate a ban the way the early cinemas did.

October 2012. MoviePass reinstates the use of its iOS app as its primary interaction with users and also brings in pre-paid debit cards. Users go to the cinema they want to attend just before the screening, open the app, pick their screening and their MoviePass debit card is loaded with exactly the right amount of money. The user goes to the cinema counter and purchases the ticket, using the card. Pricing is lower than previously, with different zones depending on where the user lives. The cheapest is available to users in rural or suburban areas (billed annually but equivalent to $24.99 a month) and most expensive for those in New York or LA (equivalent to $39.99 a month).

October 2012. MoviePass claims to have 75,000 users on the waiting list, and current users are allowed to invite up to ten friends each. MoviePass co-founder, Hamet Watt, is quoted as saying "MoviePass recently completed nine-months of closed beta trials and saw members increase their movie theater attendance by as much as 64% and their concession sales by 123%". Despite this, many are already questioning MoviePass's business model. Tech Dirt puts it nicely when they say "This business plan needs ... a number of "subscribers" to pay a minimum of $360 a year while rarely using the service in order to subsidize frequent filmgoers. The problem is that casual viewers can do the math and realize that they're losing money unless they attend more movies. And so, they'll attend more movies, making the situation better for them, but worse for MoviePass. It's what the economics kids call adverse selection".

February 2013. Andriod users (with a GPS-enabled phone) now have their own app, allowing them to use MoviePass for the first time. And using the time-honoured PR trick of mentioning dating around Valentines Day, MoviePass points out that their service means that couples go to the cinema twice as often than they used to, while single people only go 66% more often.

November 2013. MoviePass's Stacy Spikes sets out their pitch to cinema chains: "'Raise prices 5% every year’ can’t be the future. Millennials consume media in subscriptions– Netflix, Hulu–and we need to take that seriously... Theaters are open all day but are only crowded for a fraction of that. In a survey last year, we increased theater traffic 64%, users consumed more concessions, and they doubled their visits at off-peak times. Basically, we helped theaters make more money during the times they’re already open".

September 2014. A Series A round nets $2.2 million of investment from 18 investors. By this point, MoviePass cards are accepted at 93% of US movie theatres.

December 2014. MoviePass and AMC theatres agree to a pilot partnership, allowing MoviePass users to see "unlimited" movies at AMC sites. This scheme costs users $30 a month for unlimited 2D movies and $45 a month to include 3D and IMAX movies. AMC's Christina Sternberg, senior vice president for corporate strategy, said: "It frankly wouldn’t be smart to ignore the success of subscription in other areas of media". This is quite a turn-around from three years prior when AMC led the successful effort to close down MoviePass's first beta test.

June 2016. Mitch Lowe takes over as MoviePass's CEO. he was a co-founder and ex-Head of Business Development at Netflix, as well as COO at movie rental firm Redbox. He said: "If I’ve learned anything at Netflix and Redbox, being first to market really matters. MoviePass’ patented technology will allow millions of consumers to go to the movies more than ever and is proven to substantially increase attendance for the theaters. This is great news for all — exhibitors, studios and consumers".

July 2016. A new tiered pricing structure is announced, allowing users to pay $14.99 a month for up to three movies a month and $39.99 for up to a movie a day (both are just for 2D movies).

December 2016. MoviePass now has 20,000 paying subscribers.

August 2017. Helios and Matheson Analytics, a data firm, buys a 51% stake in MoviePass for $27 million. This allowed MoviePass to make a bold move - a massive drop in price. MoviePass now costs just $9.95 a month in return for a 2D movie a day - only slightly above the average US cinema ticket price of $8.84. This causes MoviePass's love-hate relationship with AMC to flip again as AMC investigates legal action to prevent the price drop. Both MoviePass and AMC experienced difficulties on the day the price drop is announced, although of very different types. MoviePass's website and app struggled under the weight of new traffic whereas shares in both AMC Entertainment and the Regal Entertainment Group fell. Later that month, MoviePass announced that they had over 150,000 paying subscribers, largely thanks to the new price.

September 2017. Technical problems continue to dog the company due to the massive influx of new customers enticed by the price drop. Mitch Lowe admitted to Bloomberg that they had "totally underestimated demand" and that this "has definitely not been good for customers or our reputation". CEO of majority shareholder Helios and Matherson Analytics said: "We are shocked and overwhelmed with our growth. The demand was so high that we’d had a shortage of Mastercards, but now we’re in the process of getting caught up. We’ve tripled our customer service personnel to meet demand. Now, we have the capability to do over 100,000 cards a week, and that number is growing. Over 70% of subscribers have their cards in hand, and all subscribers will be caught up by the week of October 2. After that, all cards will be shipped within 5 business days". When he says that they've tripled their team, he means they now have 35 employees, up from just nine.

September 2017. The service now has a reported 400,000 paying subscribers.

November 2017. Another price drop, this time a limited offer which effectively brings the price to $7.50 a month (it's billed annually at $6.95 a month, plus a $6.95 processing fee).

November 2017. Parent company Helios and Matheson Analytics says it's raising additional investment of $100 million, in part to fund further MoviePass activity.

November 2017. AMC CEO states that AMC has "no intention of sharing any — I repeat, any — of our admissions revenue or our concessions" with MoviePass.

December 2017. The Cinemark cinema chain launches its own subscription-based offering, although it's far less attractive to consumers than MoviePass. Subscribers to the Movie Club pay $8.99 a month in return for a ticket to one 2D movie a month in one of Cinemark's 350 sites and a 20% discount on concessions. Here we are already seeing the effect MoviePass has had on cheapening the cinema sector. In a pre-MoviePass world, this would have been viewed as a very competitive offer but MoviePass's impossibly low price and broad coverage mean it's unlikely to see mass take-up.

December 2017. MoviePass teams up with Costco and Fandor to offer consumers a bundle for $89.99. The pack includes a year of MoviePass (worth $120) and a year of Fandor (worth $60). Fandor is a Netflix competitor and streams over 5,000 movies from Hollywood classics to modern indie fare. The offer was only valid for seven days, between 12th and 18th December.

December 2017. MoviePass Chairman states: "In terms of expanding MoviePass’s reach, we are actively looking at expansion throughout Europe, the Middle East and Asia".

January 2018. MoviePass Chairman states: "Nearly 50% of all MoviePass subscribers go to the theaters with a non-subscriber, so the conversion among friends is very high". In a separate interview, he mentioned that the company has generated $9 million of revenue during 2017.

January 2018. MoviePass announces that in a few months it will allow location-based advertising on its platform. This will be the first non-subscription income for the firm and could become an important part of any eventual sustainable business model.

January 2018. At the Sundance Film Festival, MoviePass's CEO announces that the company will start acquiring the distribution rights to new movies. He said: "Given the successes we have demonstrated for our distributor partners in ensuring strong box office in the theatrical window, it’s only natural for us to double down and want to play alongside them — and share in the upside". Later in the month, it's announced that their first pick-up is the indie crime capper American Animals, for which MoviePass paid $3 million. The movie will be promoted to MoviePass' millions of subscribers upon release in June.

January 2018. Cinemark offers a $35 "Festival pass" allowing customers to see all nine Best Picture Oscar nominees in their cinemas.

January 2018. MoviePass CEO states: "We’re signing five contracts a week with independent theaters where we get a lower cost on tickets and that will ultimately lead to a piece of concession sales, and we have a team in L.A. striking deals with studios".

January 2018. MoviePass has stopped its customers from using the service at ten AMC sites. MoviePass are vague about the reasons why this change took place. In a tweet, AMC responded: "Some of our guests say MoviePass may be blocking the use of their service at a handful of AMC locations. AMC has not restricted MoviePass acceptance at our theatres, nor have we heard from MoviePass about this. MoviePass customers should contact MoviePass for clarification". We still don't know what happened here, but my (uninformed) guess is that it's about MoviePass proving its power to the cinema chains. Even a small drop in admissions at those ten sites would be very valuable ammunition in future negotiations.

February 2018. MoviePass CEO Mitch Lowe is interviewed on the Recode Media podcast. When discussing the sale of 51% of MoviePass to Helios and Matheson Analytics in 2017 he said: "I put in a clause where we would get a $2 million bonus if we hit 150,000 subscribers in 18 months. “I thought, ‘Okay, that gives me three or four months of padding.’ I thought maybe it’d take us a year. We got there in two days”. On the usage of MoviePass he said: "We bought a million tickets in the last 30 days at AMC theaters, across the country. That’s like $10-11 million that we paid them for tickets. Our subscribers say that they spent $12 [on concessions] every time they went to an AMC, which is more than double their average of $4.88". Here's a transcript of the whole interview.

February 2018. The Costco limited-time offer is back, but without Costco and without an end in sight. Customers now get both MoviePass and Fandor for the equivalent of $7.95 a month.

February 2018. Moviepass takes credit for an uplift in the box office performance of Best Picture nominated movies. They claim to have increased ticket sales of Call Me By Your Name by 8.8%, Lady Bird (6.2%), Three Billboards Outside Ebbing, Missouri (6.9%), The Shape of Water (7.9%) and The Post (5.6%). They also claim to have boosted I, Tonya (11.5%) and The Square (7.6%).

February 2018. MoviePass sues a new rival, Sinemia, for patent infringement. MoviePass state that Sinemia “offers a movie theater subscription service that is remarkably similar” to its own. Sinemia charges its customers $9.99 a month in return for two movie tickets, including 3D and IMAX movies.

A Bloomberg report in August 2017 claimed that MoviePass was planning to go public in "March 2018". As today's article is being written in February 2018, only time will tell if this prediction turns out to be true. They have also discussed an Initial Coin Offering (ICO), in which the company would use blockchain technology to sell virtual "coins" which can be redeemed (or traded) at a future date.

Data

The data for today's piece came from press reports, SEC filings and press releases by the companies involved. I have tried to provide links within the article to each source. If you want to read an exhaustive list of MoviePass press coverage then I recommend Crunchbase's collection.

Epilogue

I have no idea if MoviePass will work in the long-term. It's clear that their current model is unsustainable but some of the world's most valuable companies started out as growth-obsessed loss makers.

If I were given the chance to buy shares in MoviePass right now, I don't think I'd take it. But neither would I buy shares in any major US cinema chain. This normally quiet sector of the film world has suddenly become impossible to predict.