How big is the UK 'event cinema' market?

A frequently discussed shift in the film business over the past decade has been in the home entertainment sector, thanks to piracy and VOD.

However, there has been another big shift which is sometimes overlooked. This one takes place in the exhibition sector, where we've seen a new type of movie-going experience emerge: event cinema.

Event cinema performances are a hybrid of traditional cinema (projected moving images on a cinema screen) and other elements (such as theatrics, live interaction or watching live events beamed from another part of the world).

It's been a few years since I last covered this emerging sector, so I thought I'd return to see what's changed.

Event cinema's rise

It's easy to see the appeal of event cinema, both to the public and the industry. Audiences are offered a new type of night out as well as a chance to watch events they could not normally attend, whether due to price, location, schedule or because they're unique.

Meanwhile, the industry has developed in-demand content, a protection from piracy (as you can't steal a live experience) and a way to lure audiences into cinemas at a higher ticket price.

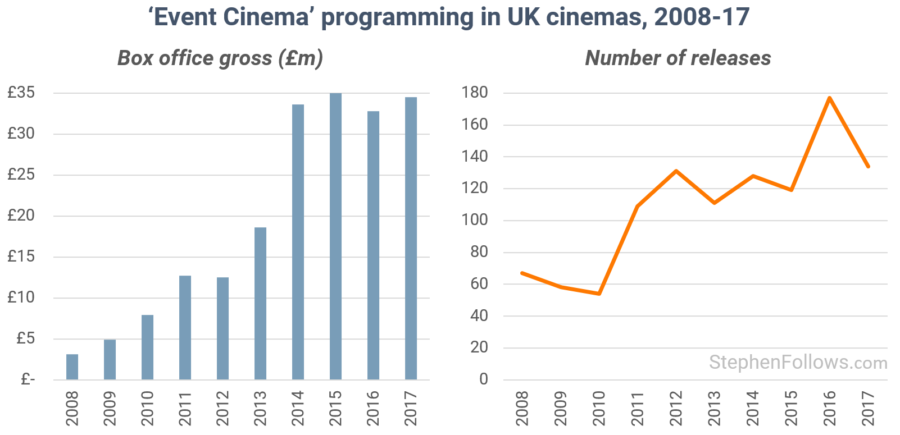

In the early 2010s, the UK event cinema business grew at breakneck speed. In the five years between 2008 and 2012, the sector grew fourfold. However, over the past few years, we've seen a levelling off of revenues, at around £33m a year.

Earlier this year, Screen International reported that the UK event cinema market was "close to saturation". The era of double-digit growth is likely over in the UK, but most other international territories have not yet seen the kind of growth and investment made by distributors and exhibitors in the UK.

Contrasting event cinema with traditional film releases

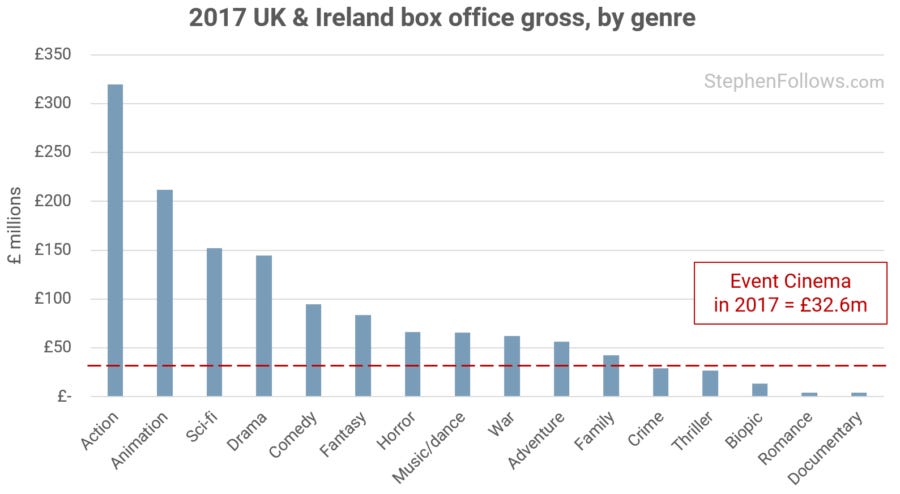

The chart below contains comScore data for last year's UK box office, where the BFI has assigned each release a single genre. Event cinema releases are mixed up among those movies (depending on their genre) but it is useful to give us a rough sense of the scale of the event cinema market.

In 2017, event cinema releases grossed £32.4m, more than crime movies, thrillers, biopics, romances and documentaries.

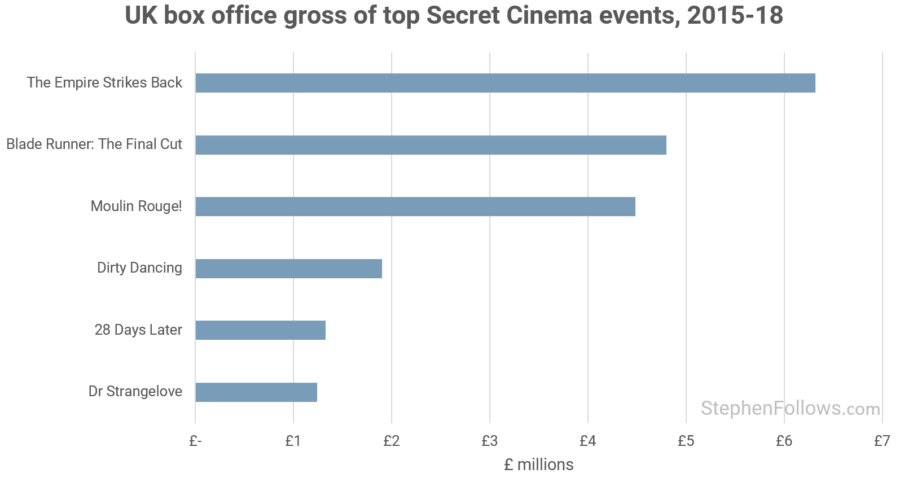

In 2017, Secret Cinema's event cinema presentation of Moulin Rouge! grossed £4.5m, making it 2017's 61st highest-grossing release, in a year which saw over 880 cinema releases. That's a higher gross than those earned by the Oscar-winning Moonlight, the brilliant A Monster Calls and the impenetrable Valerian and the City of a Thousand Planets.

The biggest types of event programming

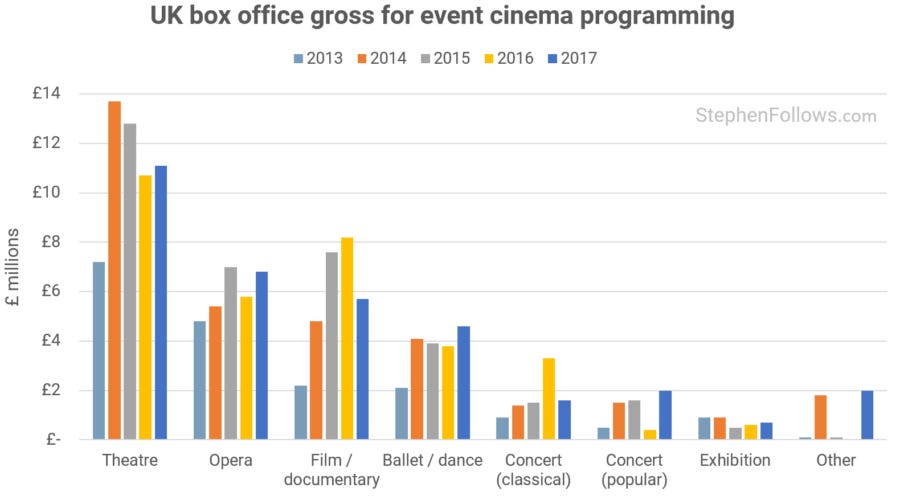

The highest grossing type of event cinema in the UK is theatre productions, accounting for over a third of all box office revenue. Opera events account for just under a fifth, closely followed by events linked to a traditional film or documentary, such as a screening followed by a live Q&A.

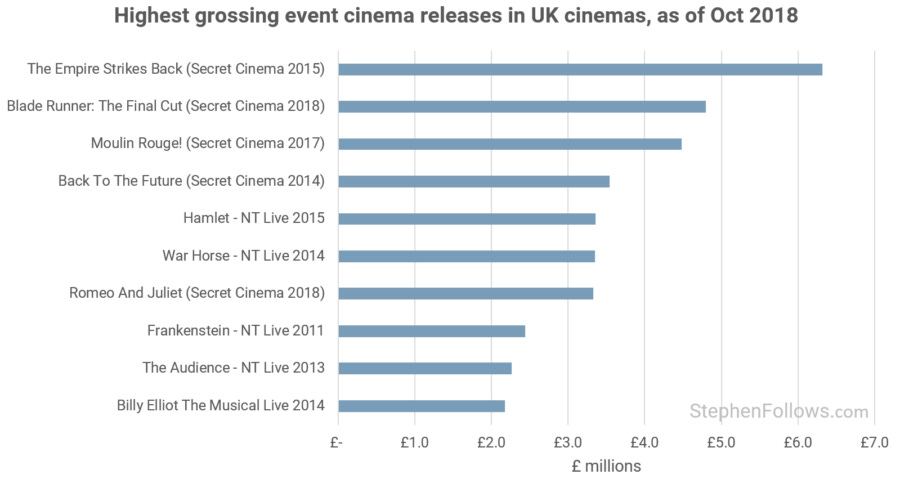

As with the wider film business, a small number of big names dominate the market. The four highest grossing event releases in the UK have all been hosted by Secret Cinema, and out of the top ten, only one was not created by either Secret Cinema or the National Theatre (under their 'NT Live' banner).

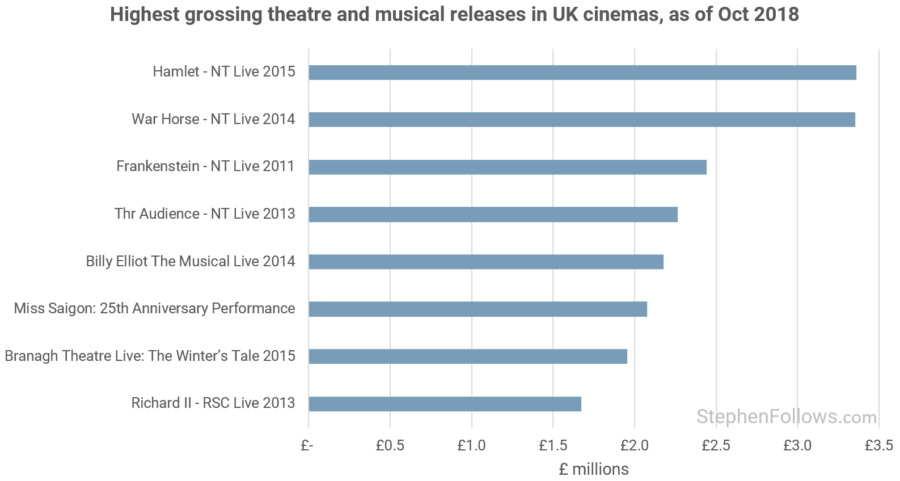

Theatre

Theatre is the largest type of event cinema release, both in number and box office gross. Most performances are transmitted live, although some are 'Encore' performances which have been pre-recorded.

London's National Theatre dominates the sector, with almost 50 productions to date. They were early players in the UK event cinema market and quick to expand.

In a 2017 paper entitled "Event Cinema as Adaptation: A stage, a screen or a compromised experience?" Dr. Nick Bamford of Bournemouth University observed: "It is interesting to note that at the end of live screenings cinema audiences are often moved to applaud because they feel they have experienced a live performance, and perhaps they are also prompted by seeing the cast take their curtain call and hearing the live audience applause".

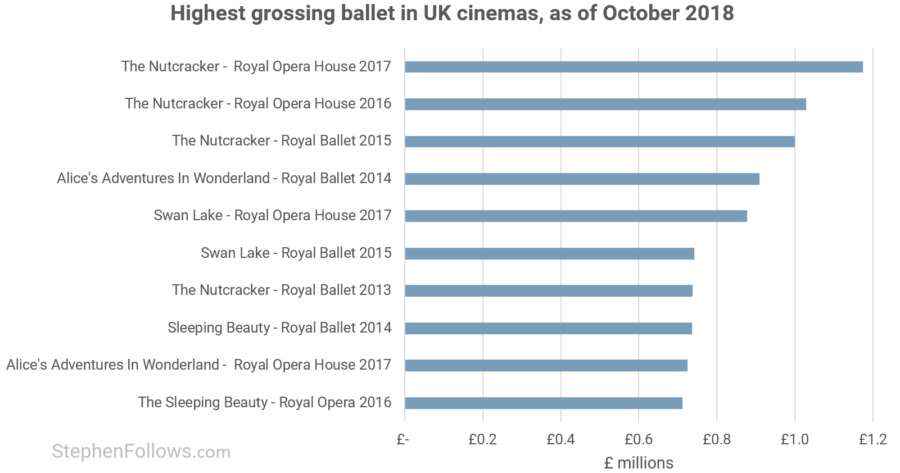

Opera and Ballet

Opera could be described as event cinema's first major format as the mass rollout of cinema performances of live events was pioneered by the Metropolitan Opera in New York. In the UK, the Royal Opera House has followed suit, as has the Royal Ballet.

So far in this article, we have spotted the same pattern a few times - namely, that a small number of players dominate the sector. This is doubly the case with ballet as firstly there only two producers in the top ten and secondly, the top ten is all based on just four stories!

Secret Cinema

Moving away from theatre, opera and ballet, we can turn to more mainstream content, and one of the biggest names in event cinema: Secret Cinema. Secret Cinema operates in two distinct models:

Secret Cinema Presents, which are large-scale, immersive worlds in which the audience can interact with props, sets and actors ahead of the screening of the movie. Audiences are encouraged (and sometimes required) to dress the part and play assigned roles in line with the movie's plot. For example, in 2014 Secret Cinema erected a 1950s town for a screening of Back To The Future, along with a radio station, barber, shops, restaurants, high school and fairground. At sundown, audience members collected on the town square to watch the movie, while 1950s cars drove around the square and stunt performers recreated Marty McFly's more adventurous actions.

Tell No One, in which audience members do not know which movie they will watch, or even where it will take place. Upon purchasing a ticket they will receive cryptic clues and instructions of what to bring. On the day, they will be told where to show up and only once on-site will they discover which movie they are about to see. The theatrics of the other events are present, although often on a smaller scale.

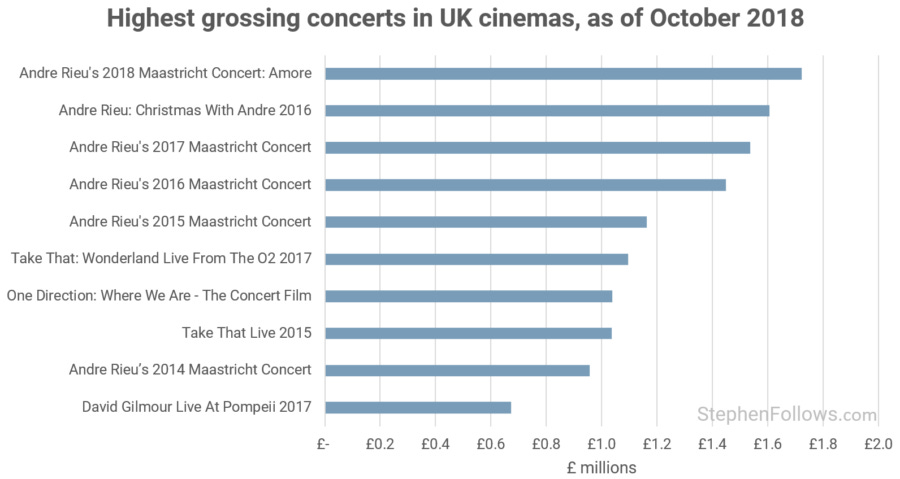

Concerts

One man rules the classical concert market: Andre Rieu. His annual Maastricht concerts dominate the top ten concert releases and continue to grow each year.

Sport

Finally, we come to a more emerging sector - sports. This year, Odeon screened the World Cup semi-final in ten venues across the UK. Football is extremely popular with Brits, and the excitement grows considerably during key international tournaments when the national team(s) progress beyond the first round. I'm not a fan of football but even I remember watching at least one football match during Euro '96 on the big screen at my local art-house cinema in East Finchley, the Phoenix. However, there are complications to rolling live football matches out to all cinemas. Free-to-air television stations purchase live broadcast rights and so if cinemas screen the match, they are not permitted to sell tickets. This means that the venues rely on the sale of concessions to make their money.

In August 2017, the Mayweather Vs. McGregor boxing match grossed £171,256 in UK cinemas, despite starting at 4am. At an industry conference earlier this year, Johnny Carr, alternative content manager at Vue Entertainment, said "We firmly believe there’s a place on the big screen for boxing. [The Mayweather Vs. McGregor fight] was a big success for us. ...Our strategy is to create a fan park atmosphere – ensuring a good attendance and that there’s atmosphere”.

Before I finish, I should briefly mention the emerging market of eSports, in which spectators watch the world's best video game players compete in major international competitions. If you've not experienced this type of sports programming before then you may be surprised to hear just how big it is. Across all media, the eSports market is projected to be worth $906 million in 2018. The vast majority of this is currently happening online, with streaming sites like Twitch taking the lion's share. However, cinema exhibitors have experimented with hosting live events with competitions such as ESL One Cologne: Counter-Strike and the EU LCS Summer Finals, which was shown in 28 screens across the UK.

Notes

Data for today's piece came from Cineplace, IHS, comScore and the BFI. I'm grateful to Michelle and Helen at Cineplace for helping me find some of the data I needed and generally for being on-hand to help.

Epilogue

So much of the film industry is either slow or resistant to change and so it's nice to be discussing an area which has seen a fast evolution over a relatively short period of time.

The rules of this new sector are still being formed, and it's not yet clear how open the market will be to players outside of the current market leaders. As we have seen, the event cinema releases are dominated by a small number of producers and almost always feature stars and brands which are already popular with audiences.

It will be interesting to see if there is scope to grow an independent sector, the way that independent film exists (well, just about).