The big changes taking place in UK film production

New figures released last week about UK film production in 2017 have prompted questions from readers about the health and evolving nature of the UK film industry.

I'm focusing on the production sector because otherwise it would be far too big a topic for one article. I've split the key changes into five points (and a bonus one at the end for good measure).

I'll start with the happier trends and work towards the less positive changes.

1. Overall, the production sector is booming

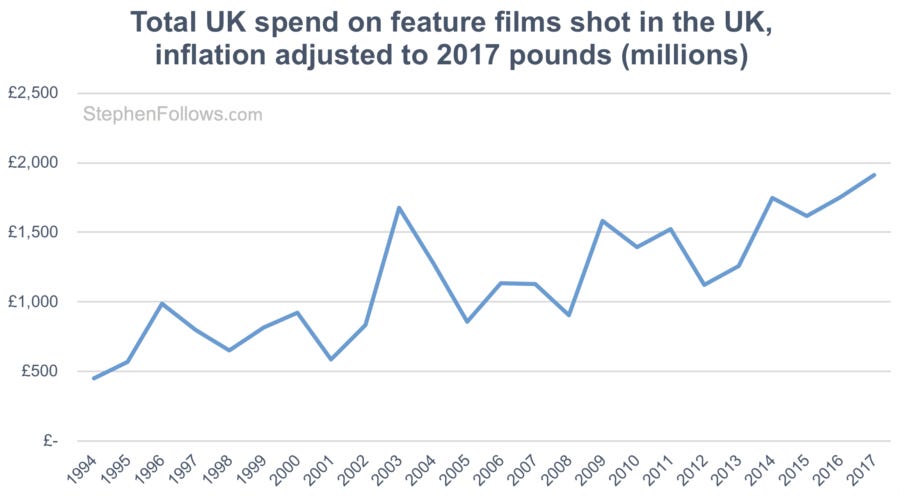

In just under twenty years, the amount spent on feature films in the UK has ballooned from £389 million in 1998 to £1.9 billion in 2017. Once we take inflation into account, this is an almost threefold increase.

Some of the biggest UK films shot during 2017 include Dumbo (directed by Tim Burton), Aladdin (Guy Ritchie), Solo: A Star Wars Story (Ron Howard), Mission Impossible Fallout (Christopher McQuarrie), All the Money in the World (Ridley Scott), Fantastic Beasts: The Crimes of Grindelwald (David Yates) and Phantom Thread (Paul Thomas Anderson).

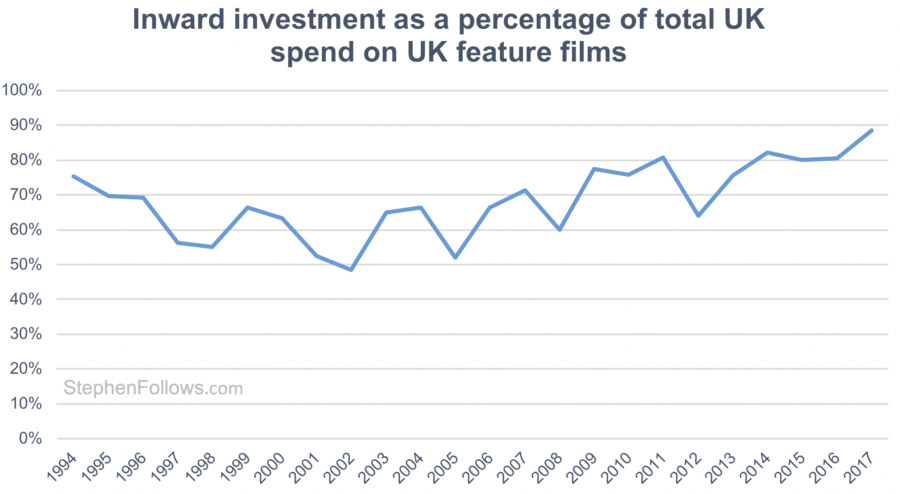

2. This boom is largely due to foreign money coming to the UK

'Inward investment' refers to the money spent on feature films which are substantially financed and controlled from outside the UK. This type of investment has become an increasingly important part of the UK film production sector over the past few decades. Last year, it accounted for 89% of money spent on films shot in the UK.

To understand why all this foreign investment is coming into UK film, we need to look at the reasons why people choose to film in the UK:

Script requirements. If their film is set in the UK then they may have little choice but to shoot some of it on location in Britain.

Infrastructure/people. A particularly complex production may require a well-trained or well-resourced set of people.

Non-governmental financial incentives. As exchange rates fluctuate, producers may spot opportunities to make their money stretch further if converted into pounds and spent in the UK.

Governmental financial incentives. Production awards (such as those given by the BFI and regional bodies) and tax breaks (such as the Film Tax Relief scheme) mean that producers can supplement their budget with money from the UK public funds.

To varying extents, all of the above factors have changed over the past few decades. Organisations such as Film London have worked to simplify the experience of filming in the UK; UK crews are becoming increasing well-trained thanks to the virtuous cycle of more production work leading to a more experienced workforce; and Brexit has meant that the pound has become cheaper to some foreign investors.

However, the government tax incentives are likely to have played the biggest part. The current Film Tax Relief scheme is very generous (producers can receive around 20% of their budget back in cash), very stable (successive governments have reaffirmed their support for it) and very easy to access (the test is simple and a breeze to pass).

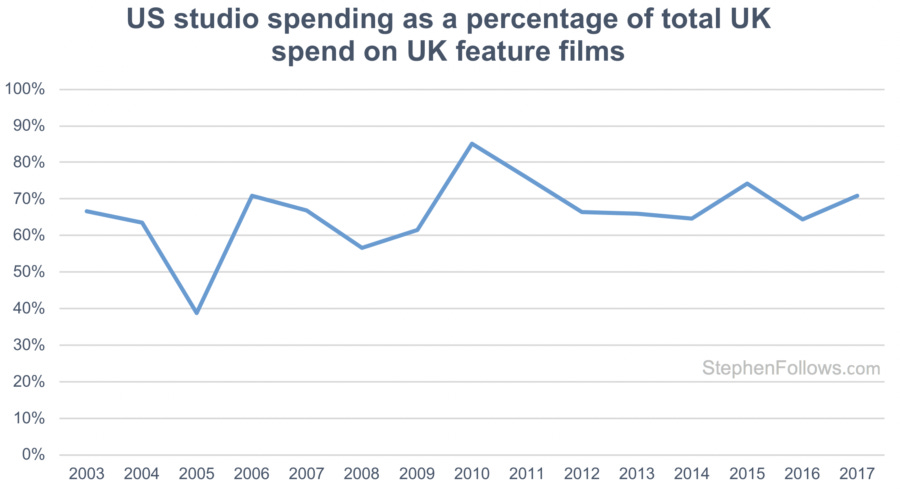

3. The UK film industry is hugely reliant on Hollywood money

71% of all the money spent on feature films in the UK last year came from the six major US studios. All of these films accessed the film tax credit, meaning that last year they could have claimed as much as £270 million back from the UK taxman.

Despite the huge amounts of money, the raw number of productions are fairly low. In 2017, just eighteen new US studio movies began shooting in the UK - i.e. fewer than 9% of the total number of new productions that year. Andreas Wiseman put it well in Screen when he described the UK film industry as "a very healthy service industry supercharged by inward investment but also of huge polarisation and little indication that the UK independent film industry is seeing significant growth outside of its collaborations with the US".

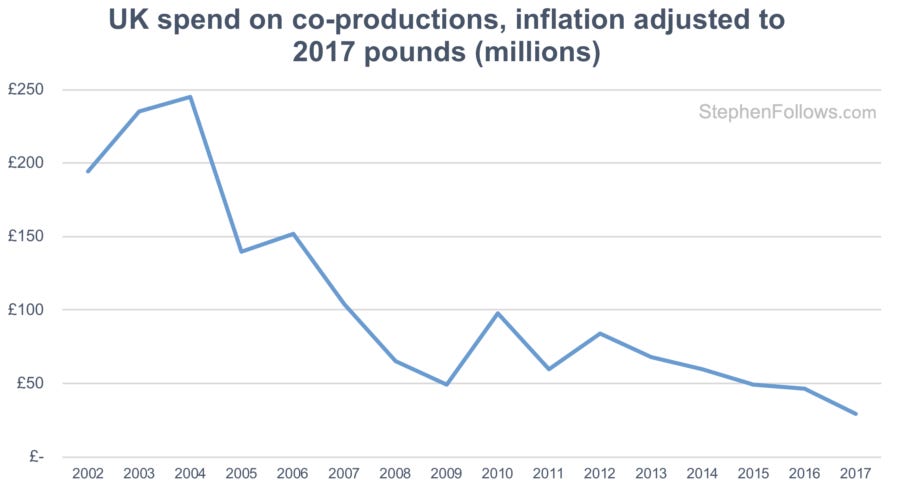

4. There has been a collapse in co-productions

In the early 2000s, co-productions between Britain and other countries were extremely common, often accounting for more than half of all films shot in the UK. Changes in tax policy since then have meant that the advantages of a co-production now rarely outweigh the added complexity and costs involved. Last year, just 13 films chose to use a co-production structure, and their combined spend was just 1.5% of the total UK film production.

5. The low-budget bubble has well and truly burst

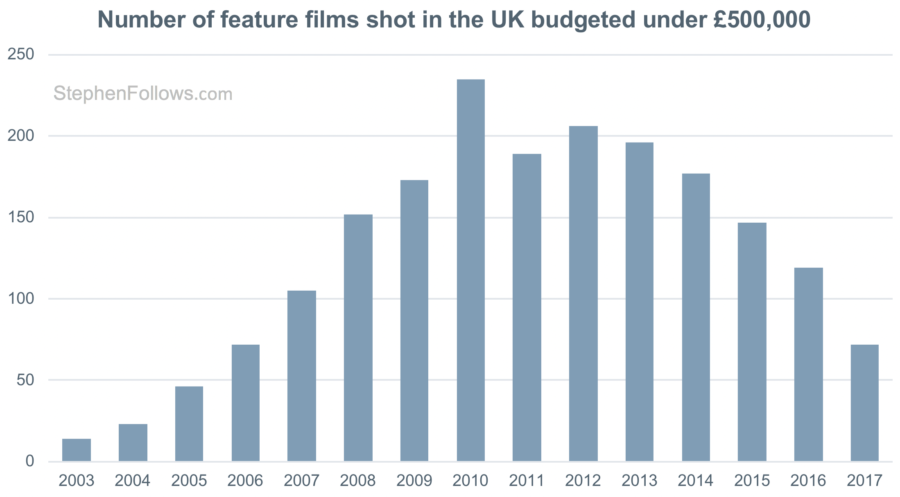

In 2010, 63% of all films shot in the UK cost under half a million pounds. Just seven years later, that figure has plummeted to 34%.

I have written before about the reasons for this bubble, so I won't spend time here going over them again. Suffice it to say that it's largely a result of overly-enthusiastic filmmakers in the late 2000s harnessing new technologies to make movies, almost all of which failed to recoup their costs. This disillusioned the filmmakers, scarred the investors and reduced goodwill for low budget productions among cast, crew and facilities. Added to that, beginner filmmakers now have new routes to showcase their films online and make money doing so via YouTube, Patreon, et al.

Low and micro-budget filmmaking still survives but such productions are far less common than they were ten years ago. Public funding schemes such as Film London's Microwave (for films with budgets up to £150,000) and Creative England's iFeatures (budget max of £350,000) use the low budget model to help filmmakers gain experience and exposure.

Interestingly, it could be that projects which would once have been structured as a micro/low budget feature film are today becoming low-budget television projects. Only last week, Sky's head of drama, Anne Mensah, said that she was looking for low budget “more heartfelt” shows which “tap into British values”. Similarly, Channel 5's head of drama, Ben Frow, called for low budget television projects in October last year and received an "overwhelming" number of projects from producers.

6. High-end television production is booming

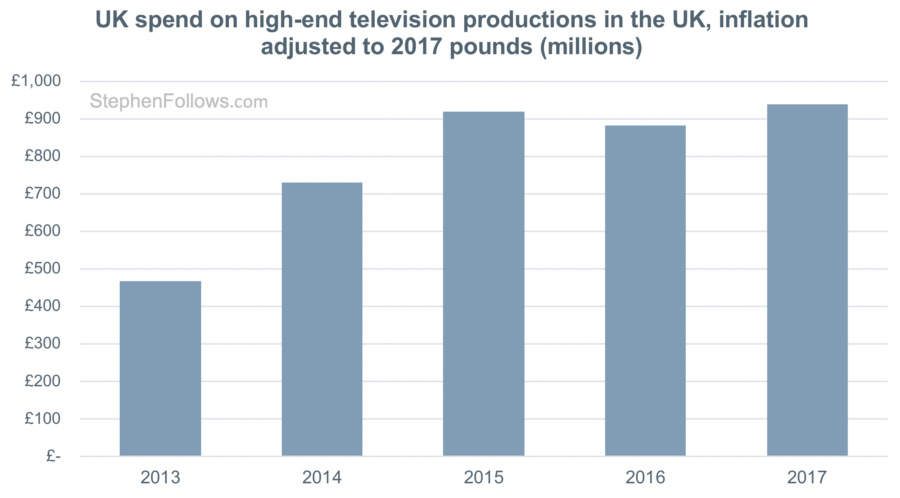

This section shouldn't really be on the list as it doesn't directly relate to feature film production, but I thought it was both interesting and relevant to the discussion of fewer low budget films. In April 2013, the UK government introduced a tax relief scheme for television projects, modelled on the successful Film Tax Relief scheme. The aim was to encourage high-budget British television productions to shoot in the UK.

Prior to the scheme, a number of high profile productions had opted to shoot abroad, including BBC’s Merlin (partially shot in France), ITV’s Titanic (Hungary) and the BBC/HBO's Parade’s End (Belgium). The scheme provides a rebate of around 20% of the UK production spend, but only applies to productions with a budget of at least £1 million per broadcast hour.

The result is that spend more than doubled between 2013 and 2015, although it remains half that of UK feature film production.

So it seems as if the British television industry is experiencing a similar tax-funded boom that we're seeing in film. Interestingly, the key players are making more of a noise about the content of the productions than the film industry. For example, ITV's head of drama, Polly Hill, said “The money has unbelievably changed the drama landscape, but what hasn’t changed is getting people to watch and having a British element".

Notes

The data for today's article came from the BFI, the Cinema Advertising Association, comScore and the Office of National Statistics. It's worth noting that as time goes on, the BFI are able to locate and track more films from previous years and so some very recent numbers may well be revised upward. This will disproportionately affect smaller films as it can be easy for the BFI not to know that a micro-budget shoot has taken place, whereas they are unlikely to miss the shoot of the next Star Wars movie! As they discover films they previously missed, they add to the data in future publications.

I studied this pattern of initial underreporting a few years ago to see how much of an effect it had on the data. Across all films shot in the UK, the figure for the previous year’s production levels (i.e. the 2010 data in the 2011 Yearbook) only included 74% of the films which were eventually attributed to that year (i.e. the 2010 data in the 2015 Yearbook). The stats were much more accurate for films budgeted over £500,000 - 93% of which were listed the following year - compared with just 64% of the films made on under £500,000. This means we should assume that the most recent data mentioned above (i.e. 2017 production data) is not yet showing the full picture. That said, multi-year trends are still likely to be the same.