How much do Oscar nominations help films in theatres?

Tracking over 11 million screenings over three years to look at the effect of receiving a 'Best Picture' nomination.

As the Oscar race heats up, I am continuing to study how the industry anticipates and responds to the events along the way to the ceremony in late February.

So far I have looked at:

Today I have teamed up with the lovely folks at usheru to study the effect of a movie being nominated on the availability of that movie in cinemas.

usheru provide data-driven marketing solutions and analytics to the global film industry.

Using their data, I was able to track the number of showtimes in US cinemas for the thirty Best Picture nominees over the past three years, leading up to, and following on from, the announcement of the Oscar nominations.

Across the three years covered here, the timing of the Oscars followed the same broad shape. Films were released throughout the year, nominations were announced in mid-January, and the ceremony itself took place six to eight weeks later, in late February or early March.

Not a cohort of equals

The first thing that jumps out is that Best Picture nominees are a fairly broad church. They differ in a number of ways.

Scale. Across the years studied, the slate ranges from genuine mega-blockbusters to small independent films. Just four titles (Top Gun: Maverick, Avatar: The Way of Water, Barbie, and Oppenheimer) account for roughly two-thirds of the combined global box office gross of all 30 nominees. At the other end are films such as Past Lives, Women Talking, Anatomy of a Fall, and The Zone of Interest, which played to far more limited theatrical audiences.

Release date. Dune: Part Two was released more than eleven months before nominations were announced, whereas A Complete Unknown arrived less than a month beforehand.

Intended audience. Some nominees are designed as mainstream, four-quadrant releases, while others are clearly aimed at more specialised audiences. Films such as Tár, The Zone of Interest, and Triangle of Sadness skew toward an arthouse crowd, while a small number (notably Everything Everywhere All At Once) managed to cross over between niche and mainstream appeal.

Origin. Alongside Hollywood releases sit non-US titles such as Past Lives, Anatomy of a Fall, All Quiet on the Western Front, and The Zone of Interest, each arriving with different distribution strategies and theatrical expectations.

First-run status. Some nominees were headline theatrical events (see Barbenheimer( while others had little or no conventional theatrical run at all, such as Netflix’s All Quiet on the Western Front.

Taken together, this means the Oscar slate does not start from a level playing field. When we’re looking for a nomination-related programming effect we need to remember the radically different baselines, constraints, and opportunities.

Is there a post-nominations boost in screenings?

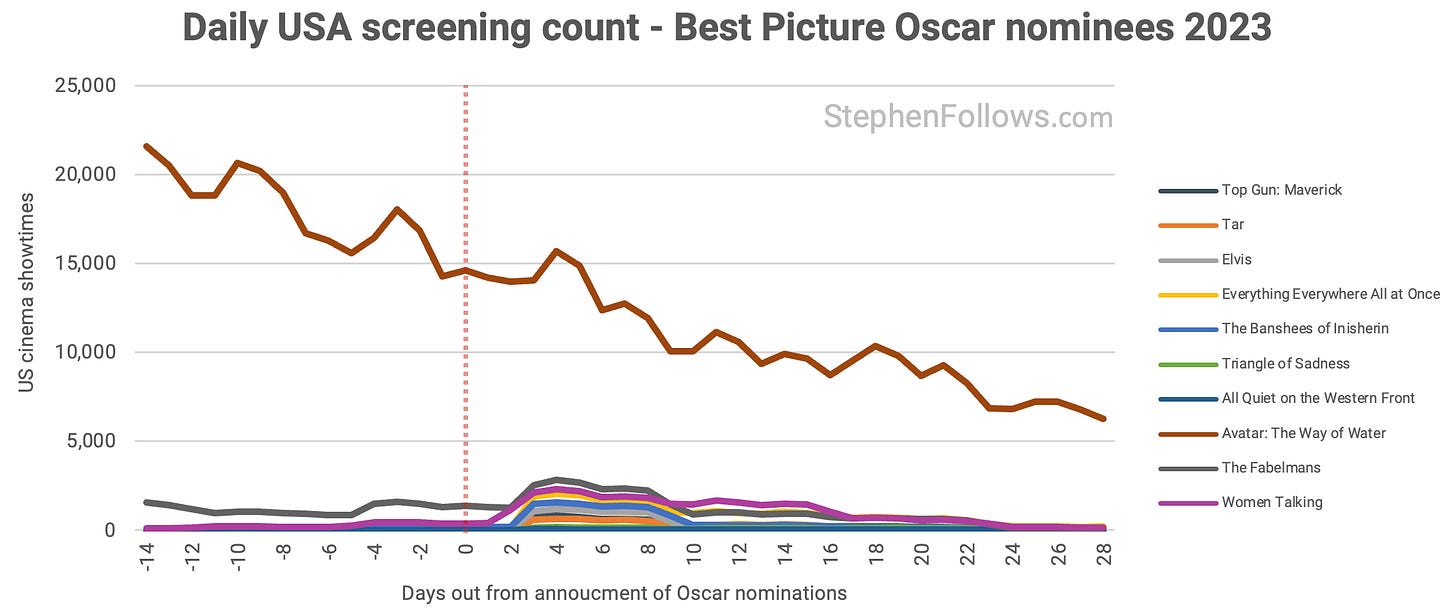

We can see below how this mixed cohort played out in 2023. There certainly was a nominations boost for most of the nominees but it’s hard to chart it when we include bedfellow Avatar: Way Too Much Water, which was the biggest film of the year and had opened just six weeks prior.

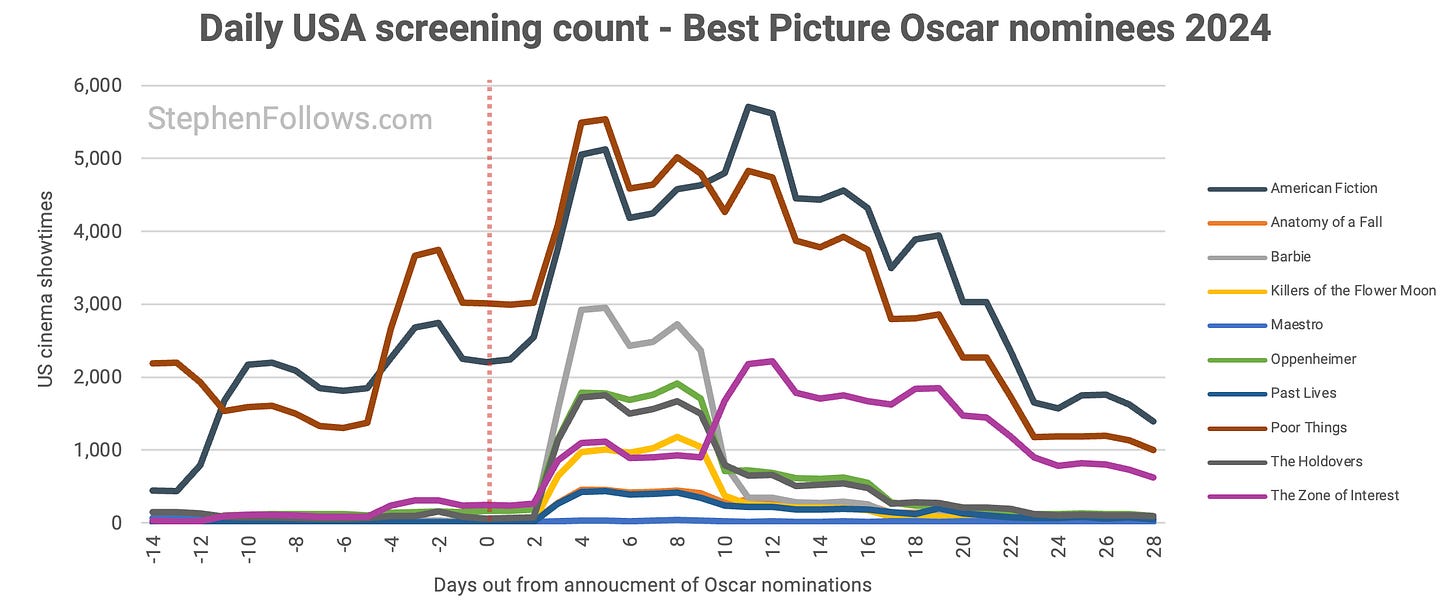

The picture is a lot clearer in 2024. A couple of films (Poor Things and American Fiction) saw their screening count rise in the fortnight leading up to the nominations, presumably because the industry, press, and public expected them to be in the line-up. Most of the other nominees received a boost just a few days after being confirmed on the shortlist.

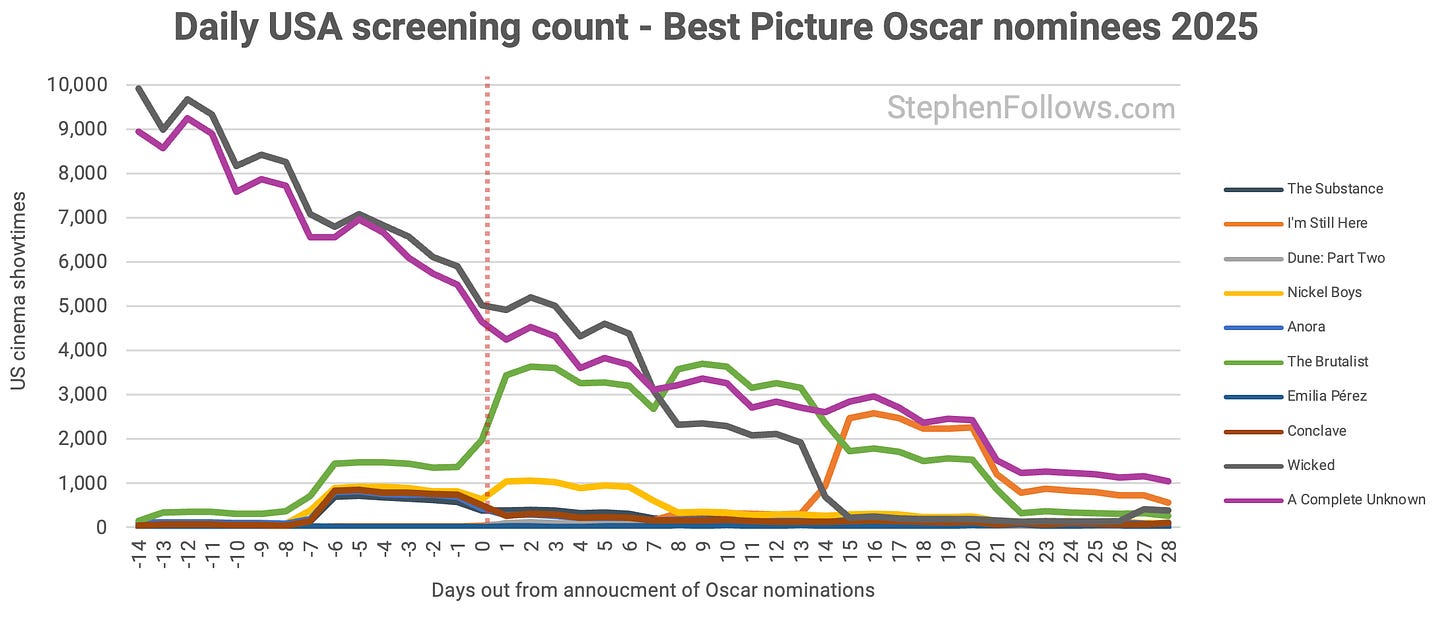

2025 combined the two effects, with The Substance and A Complete Unknown still finishing their first run, meaning we can’t detect a nomination uptick, whereas The Brutalist and Nickel Boys show a clear boost.

What are the patterns?

Across the three years I studied, the films broadly fell into three types:

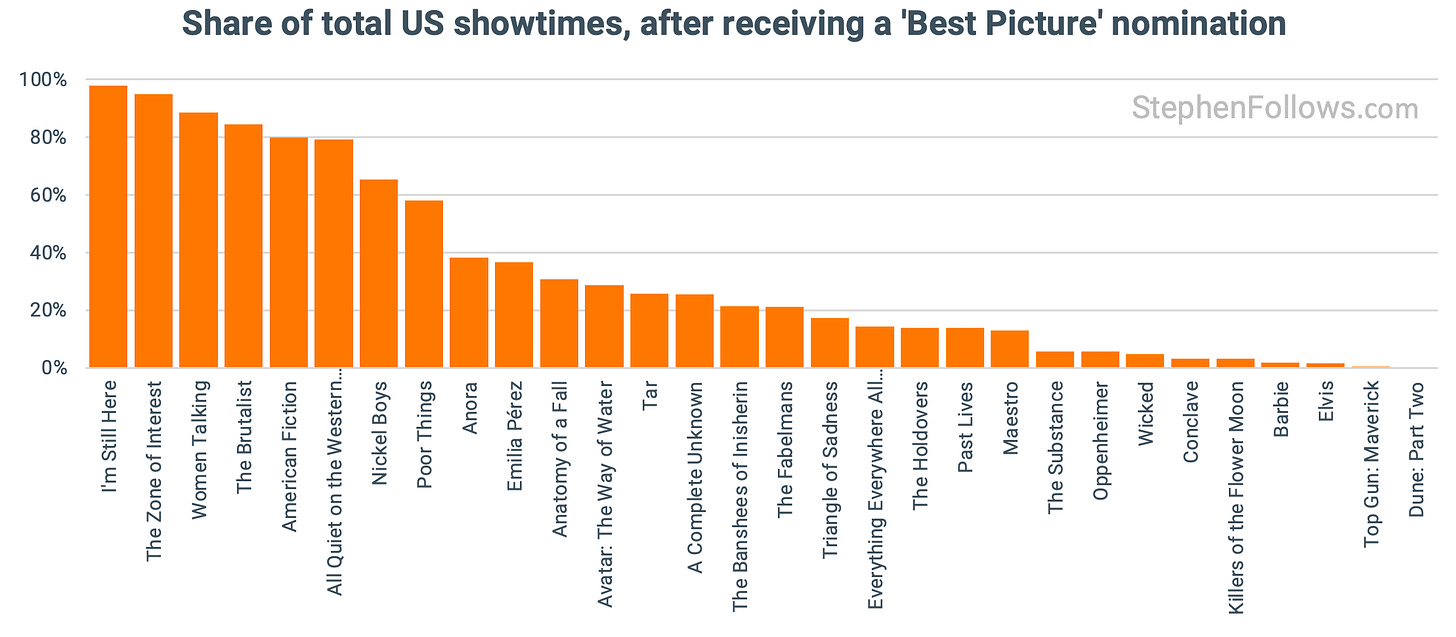

Mega-releases where nominations barely moved the needle. These films already had huge availability before nominations so any Oscars bump gets lost in the baseline. Such as Top Gun: Maverick (0.5% of showtimes after nominations), Dune: Part Two (0.4%), Barbie (2.0%), Elvis (1.8%), and Wicked (4.8%). Even Oppenheimer sits in this bucket (5.7%), despite being the eventual winner, as it’s principal run meant far more than the extra Oscar buzz.

Mid-sized theatrical releases where nominations helped, but didn’t transform the run. These films got a clear post-nominations lift, but it usually represented a minority of their overall showtimes. The nomination acted as a nudge to extend, widen slightly, or reintroduce the film to more sites, rather than rebooting its theatrical life. Examples include The Fabelmans (21.2% after), The Banshees of Inisherin (21.5%), Triangle of Sadness (17.4%), Everything Everywhere All At Once (14.4%), The Holdovers (14.0%), Past Lives (14.0%), Tár (25.9%), and A Complete Unknown (25.5%).

Small, specialist, or platform titles where nominations created most of the theatrical availability. This is where the Oscars look most “real” in programming terms. These films either had limited theatrical exposure pre-noms, or they were past their natural run, so the nomination became the main reason they were on screens at all. This included I’m Still Here (98.0% of showtimes after nominations), The Zone of Interest (94.9%), Women Talking (88.6%), The Brutalist (84.5%), American Fiction (79.9%), and Netflix’s All Quiet on the Western Front (79.2%).

Notes

I’m very grateful to Alex Stolz and his team at usheru for the data and support. Extra data came from OMDb, The Numbers, Box Office Mojo and Wikipedia.

Today’s research was looking at the feature films nominated for the ‘Best Picture’ award at the Academy Awards in 2023, 2024, and 2025. Screening counts are the daily counts in the US according to the usheru system.