48 trends reshaping the film industry: Part 3 - Distribution and exhibition

This is the third instalment of a four-part series chronicling trends and changes in the film industry.

To compile the list, I have been back through all of my old research, conducted new projects, read outside research and solicited suggestions from my industry readership (thank you to everyone who contributed).

The result is a list of 48 trends and changes affecting the film industry. For readability, I have split them into four groups:

Distribution and exhibition (see below)

25. Cinemas are showing far more than just traditional movie screenings

In the first half of the 20th century, there was a lot of change in what cinemas screened. They started showing very short gimmicky films, added live music, replaced the music with soundtracks, added newsreels, double features, etc. In the second half of the century, things settled down and the public started to expect the same basic program from all cinemas - namely adverts, trailers and then one feature-length film.

But recently, cinemas have started to think more creatively about their programming. We have seen a boom in:

Crowdsourced screenings (such as those organised by ourScreen)

Live events in cinemas (such as National Theatre performances broadcast live)

Immersive theatre / cinema hybrids (such as Secret Cinema).

At the same time, the big Hollywood blockbusters are getting bigger, with ever-larger advertising campaigns and they rely on 3D and IMAX for a large chunk of their income. If this split continues, then it could lead to an even greater gulf between what I like to call ‘Big Cinema’ (i.e. global cinematic releases based around spectacle) and ‘Specialized Cinema’ (i.e. more local, personal and bespoke cultural performances).

Further reading: Six ways the film business is changing

26. Teenage audiences are losing interest in the cinema

In another challenge to how cinemas have operated in the past, young people are making up a smaller share of cinema audiences. In the US, cinema-goers aged between 12 and 24 bought 34% of cinema tickets in 2009 but by 2016 this had declined to 29%. Similarly, in the UK, 15 to 24-year-olds bought 35% of tickets in 2011, but this fell to 29% in 2016.

This trend is worrying many, and none more so than cinema owners who have long relied on packs of these easy-to-please, sugar-filled, high-spending customers. A recent study found that European cinema owners are twice as concerned about the dwindling numbers of young cinema-goers than they are about piracy.

Further reading: Are fewer young people watching movies in cinemas?

27. The oldest cinema-going demographic is rising

While young people may be losing interest in trips to the cinema, the oldest audience demographic is increasing rather rapidly. The “55+” segment of UK cinema attendees has grown by a third between 2008 and 2015. This is due to a number of factors including the ageing Baby Boomer generation, longer life expectancy, increased mobility among retirees and a generation raised on cinema trips.

This shift has heavily contributed to box office successes such as The King’s Speech and The Best Exotic Marigold Hotel and has shown filmmakers that there is an under-served audience in what was assumed to be a saturated marketplace.

Further reading: Six ways the film business is changing and What films are older cinemagoers watching?

28. The most profitable independent movies often appeal to older audiences

Part of the reason why European cinema owners are worried about the loss of younger audiences is that they were heavily influenced by marketing and star power, both of which meant that bad movies could still do well. By contrast, the older demographic is much more interested in the quality of a movie before committing to see it on the big screen.

What's Hollywood's loss is independent arthouse's gain. Very high-quality movies (mostly dramas) have found that their core audience is growing in size, helping both attendance and their bottom line. In a study I carried out with Bruce Nash from The Numbers, we looked at the most profitable independent movies and discovered that almost half owed their huge success to older film fans.

Further reading: Patterns among the most profitable movies budgeted $10m to $20m

29. More movies are being released theatrically than ever before

In 2016, there were 736 films released in US cinemas; twice the number in 2000.

To get a better sense of what's happening, let's split these numbers into two groups – films by one of the six major Hollywood studios (i.e. Warners, Disney, Fox, Paramount, Sony and Universal) which have a wide release (i.e. in at least 1,000 cinemas) versus all other films. This shows us that the large growth in film releases has not come from the big Hollywood movies we hear so much about. In fact, they’ve dropped slightly. In 2006, there were 128 such “wide Studio releases” and in 2016 it was just 93 (a 27% reduction).

The same pattern is visible in the UK which last year saw an average of fourteen new films released in cinemas each week – double the figure fifteen years ago.

Cinema attendance has only risen by 16% over the same period, meaning that movies have had to work harder to be seen. Added to this, the top 50 movies each year grossed around three-quarters of the annual box office revenue, meaning the remaining 650-odd movies are all competing for the other 25%. So it's now harder than ever for an independent film release to get noticed and recoup its costs.

Further reading: How many films are released each year?

30. Movies make it around the world quicker than ever before

In the 1990s, there was a significant delay between the American release of a movie and when it made its way onto the big screen in other countries. At the turn of the century, the delay between US and UK releases across all movies was an average of 135 days. Over the following sixteen years, it dropped by 96%.

And this trend has been mirrored in most developed countries, thanks to a mix of Hollywood's desire to minimise losses associated with illegal piracy, the advances of distribution technology and the power of global marketing on social media platforms.

Further reading: Three major ways movie release patterns are changing

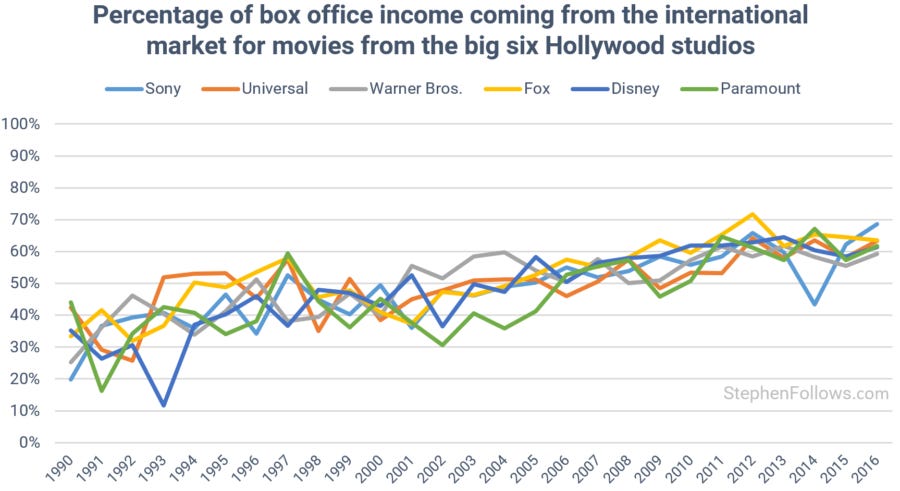

31. Increasing international revenues are driving Hollywood decisions

In the film industry, the term 'domestic' refers to the North American and Canadian market and everyone else is known as 'international'. In the early 1990s, the average studio movie would earn 35% of its total worldwide box office in the international market. Since then, the international share of revenues has grown and in 2016 accounted for 63% of the worldwide gross.

The first time international box office revenues for Studio movies surpassed domestic was in 1997, mostly due to the strong global performance of just three films: Titanic (70% of the global intake came internationally), Men in Black (57%) and The Lost World (63%). But it wasn’t until 2003 when international revenue dominated the domestic market for good.

This increasing dependence on international revenues is affecting Hollywood's creative decision-making. Some effects are gentle (such as focusing on stories which will translate well to other cultures and languages), while others are more worrisome (such as the influence on the representations of China and the Chinese government).

Further reading: How important is international box office to Hollywood?

32. Digital releases happen before physical releases

Video on Demand (VOD) is still evolving as a market but has been growing in importance over the past decade. This dominance can also be seen in the changing of movie release patterns. Historically, the ‘third window’ (i.e. home entertainment) was a critical income stream for movies. Therefore, it is interesting that, on average, movies now come out digitally before they are available to buy or rent physically. Across all movies, VOD is the new third window.

Further reading: Three major ways movie release patterns are changing

33. Movies transfer faster from cinemas to homes

In 2000, Hollywood studio movies were released on home video an average of 171 days after their initial theatrical release (i.e. almost six months later). In 2017, this average was just 105 days, representing a 39% fall.

The cinema chains are not happy about this as they see it as an existential threat to their business. They worry that if they lose their window of exclusivity then their fate will be the same as the video rental store, which became obsolete once consumers could buy DVDs on the same day they were released for rental.

Further reading: Three major ways movie release patterns are changing

34. Interest in 3D movies is declining

3D cinema is almost as old as film itself and we are currently living through the fourth 3D movie boom. The first was in the 1920s, then the 1950s, 3D picked up in the 1980s and our current boom flourished in the 2010s. But recent data suggests that audiences are tiring of 3D movies and opting to see movies in 2D when given the choice.

If we look at the percentage of the total box office gross earned by 3D versions of movies, we can see that 2010 was a high point. Since then, both the UK and North American markets have experienced a near-consistent decline in the 3D share. In 2010, 22% of US revenues went to 3D movies whereas by 2016 it was just a third of that, at 7%. Similarly, the UK 3D cinema market share fell from 21% in 2010 to 14% in 2016.

Further reading: Are audiences tiring of 3D movies?

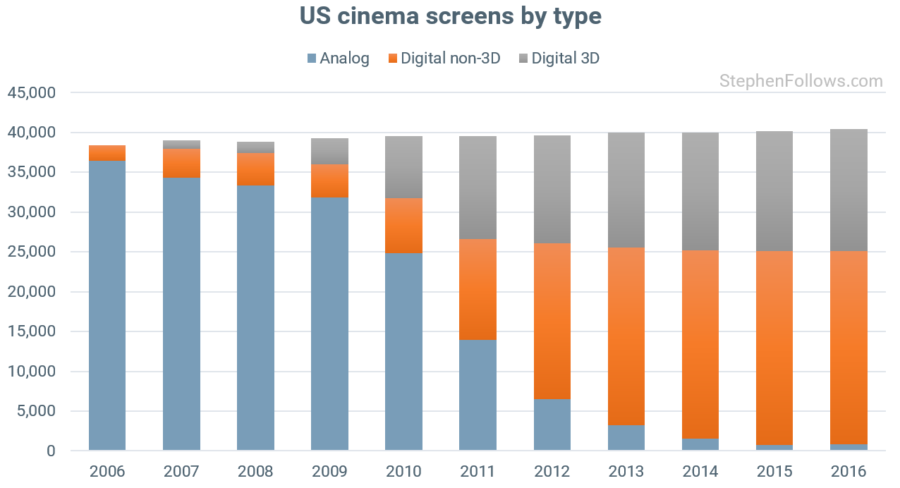

35. Exhibition is now almost entirely digital

In 2006, 95% of US cinema screens were analog and as such projected movies from reels of 35mm celluloid film. This was an expensive and bulky experience for all involved. Distributors needed to make and ship huge, expensive prints and cinemas had to combine six or so reels together and then disassemble them a few weeks later. The more they were used the dirtier and more scratched they became, and at the end of the run they were hard to recycle.

Ten years on and the US cinema are almost entirely digital with just 2.2% of screens sticking to analog projection. Digital prints are much cheaper to produce and ship, they can be higher quality, never deteriorate, are much easier to recycle and have vastly better protections for copyright owners.

Further reading: When and how the film business went digital

36. Cinema ticket prices continue to rise - sometimes in sneaky ways

Cinema tickets are rising in price faster than inflation. In addition, the industry has developed new reasons to charge cinema-goers more, including extra charges for 3D, IMAX and blockbuster movies.

When I looked at this topic in detail, I found one cinema which fifteen years ago offered just 5 price options and was now offering at least 224 variations of ticket price. These price rises and sneaky extra charges mean that the price of cinema trips is the topic people most complained about to cinema staff.

If the average ticket price shown above feels low to you, it could be due to the slightly biased way the industry calculates it. Both in the US and the UK, the industry divides the total box office gross by the number of tickets sold. This produces a lower figure than is probably the case as it doesn't take into account free tickets or discounts. In my research, I discovered that the average price of a standard 2D off-peak cinema ticket in the UK was £9.84 - way above the industry 'official' average of £6.72.

Further reading: What’s the average cost of a cinema ticket? and The thoughts of UK cinema staff

Notes

The data for today's article came from a variety of sources, including the MPAA, Bureau of Labor Statistics of the United States government, IHS Screen Digest, Wikipedia, NATO, IMDb, MovieInsider, Opus / The-numbers, Box Office Mojo, Rentrak, IHS, Attentional, British Video Association, Official Charts Company and the BFI. If you want to know more about a particular chart then I suggest following the 'Further Reading' link as it will provide more context and details of the data source(s).

Epilogue

If you think I've missed anything important then please do contact me via my contact page or leave a comment below.