Change in the film industry is often an extremely gradual process. The views of those involved tend to be entrenched and hard to shift. Therefore, how the film industry will operate one year can reasonably be expected to be very close to that of the year before.

Change in the film industry is often an extremely gradual process. The views of those involved tend to be entrenched and hard to shift. Therefore, how the film industry will operate one year can reasonably be expected to be very close to that of the year before.

Not so 2020. The current COVID-19 pandemic has forced a number of huge changes upon the sector over a matter of days. Cinemas are shut, productions are on hiatus and almost everyone is at home watching TV and VOD content.

In order to take the industry’s temperature at these uncertain times, I teamed up with Screendollars to interview 363 film professionals. We focused on the domestic market (i.e. USA and Canada) and asked a range of questions about their views on the current changes and what they think a post-lockdown future may bring.

We split respondents into five groups, based on their area of professional work:

- Filmmakers, covering development, production and post-production.

- Sales & Distribution, including sales agents, distributors and marketers.

- Exhibition, cinema owners and operators.

- Home Ent, TV & VOD, including physical and digital sales, all forms of VOD and films on television.

- Other, including those in education, government bodies, festivals, journalism, cinema suppliers and more.

Mood of the industry

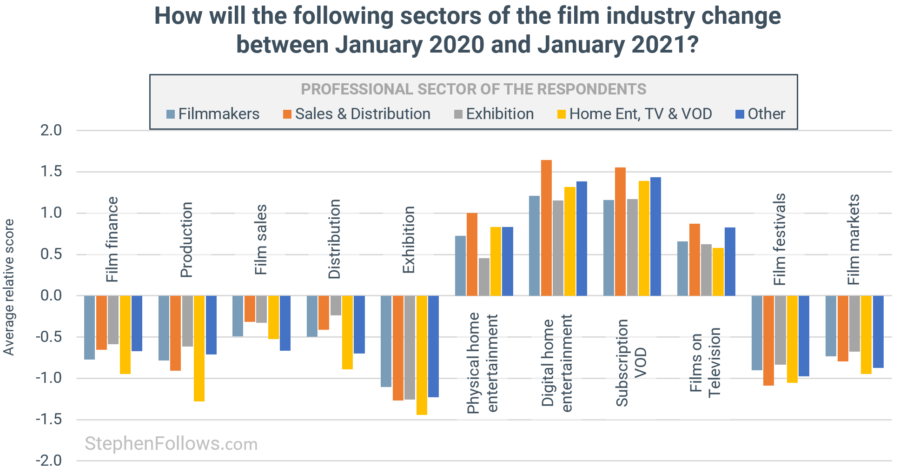

The vast majority of respondents agreed that COVID-19 has negatively affected all aspects of the film industry which take place outside of people’s homes. Furthermore, there is a cross-industry consensus that the exhibition sector has been the hardest hit by the pandemic.

The chart below shows the perceived impact of the pandemic on each sector of the industry. An average score of zero would show that the respondents felt there would be no change between January 2020 and January 2021 for the sector in question. Therefore, a negative score reflects a perception that things will be worse, and a positive score reflects a better future.

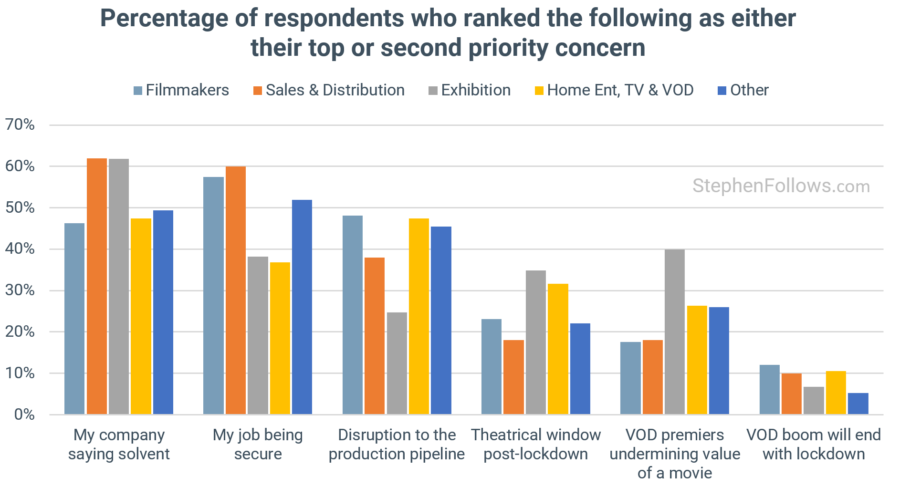

Despite most agreeing that the long-term will be kind to the people supplying movies to consumers’ homes, those involved are still worried about their current positions. Almost half of the people working in Home Entertainment say that the solvency of their employer is their top or second concern.

Breaking windows

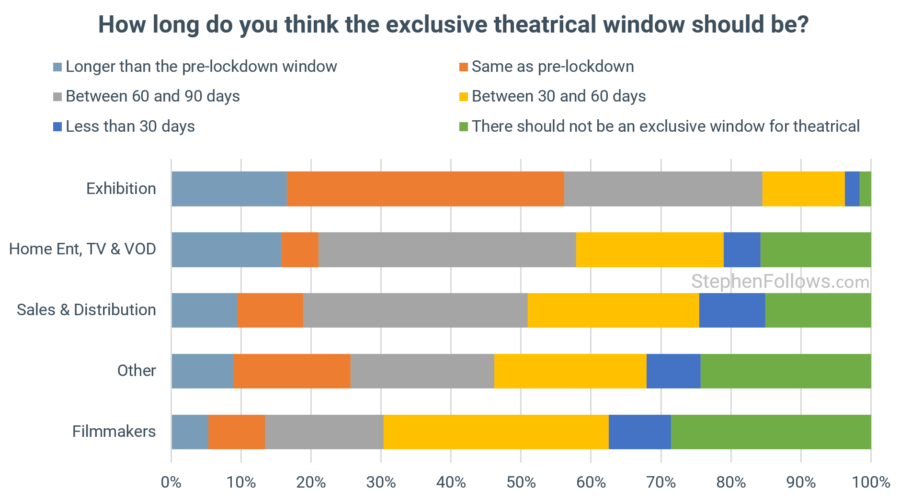

Perhaps the most consequential changes to the industry are being felt in the exhibition sector. Over the past decade, cinemas and studios have fought a slow battle over the amount of time a new movie should be exclusively available in cinemas (known as the theatrical window), which currently sits at 90 days.

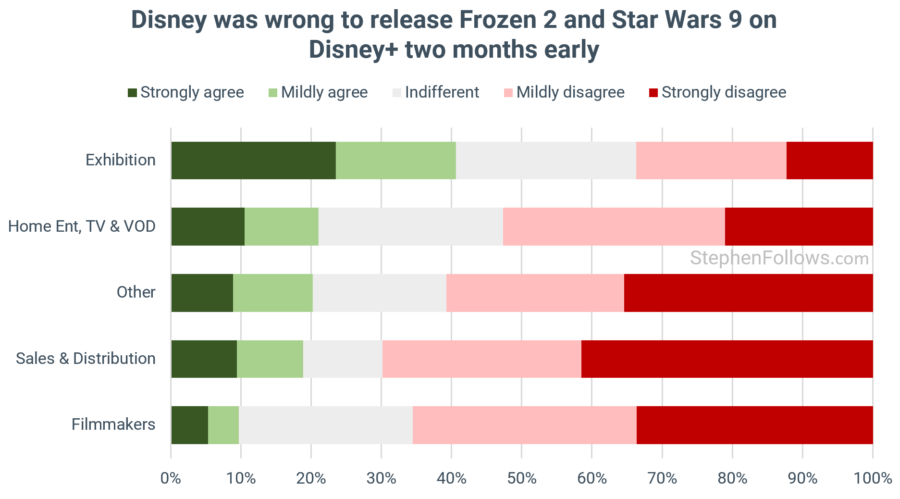

Despite this, the pandemic has seen a number of releases break the window detente. Disney brought Frozen 2 and Star Wars to digital platforms sooner than expected and Universal eschewed the traditional theatrical release for Trolls World Party altogether.

The research reveals a deep divide between the makers of movies and those who screen them in cinemas. Only 30% of filmmakers think the theatrical window should be longer than 60 days, compared with 84% of those in exhibition.

Only a third of people working in Exhibition agree with Disney’s decision to release Frozen 2 and Star Wars early on their SVOD platform, Disney+. This is far fewer than those in Sales and Distribution (70% of whom agree) and filmmakers 66%).

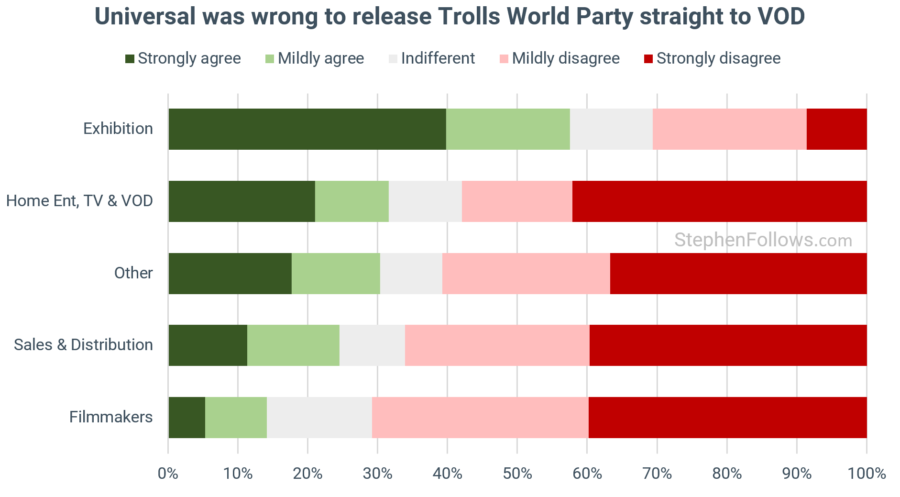

A similar pattern is seen in relation to Trolls World Party, with just 14% of filmmakers thinking Universal made a misstep with their VOD premiere compared with 58% of those in exhibition.

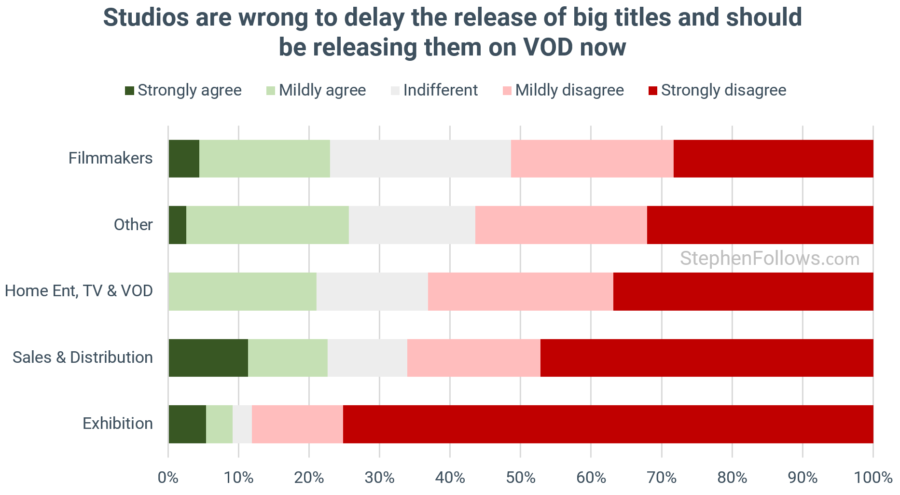

Despite these specific examples, it’s interesting to note that half of the filmmakers don’t think studios should be skipping theatrical releases for their upcoming titles, with only a quarter of filmmakers actively supporting a VOD-first approach.

Unsurprisingly, the folks in Exhibition are still very much pro studios releasing films in their cinemas first, with fewer than one in ten supporting the studios’ VOD release strategy.

Expectations of the post-lockdown future

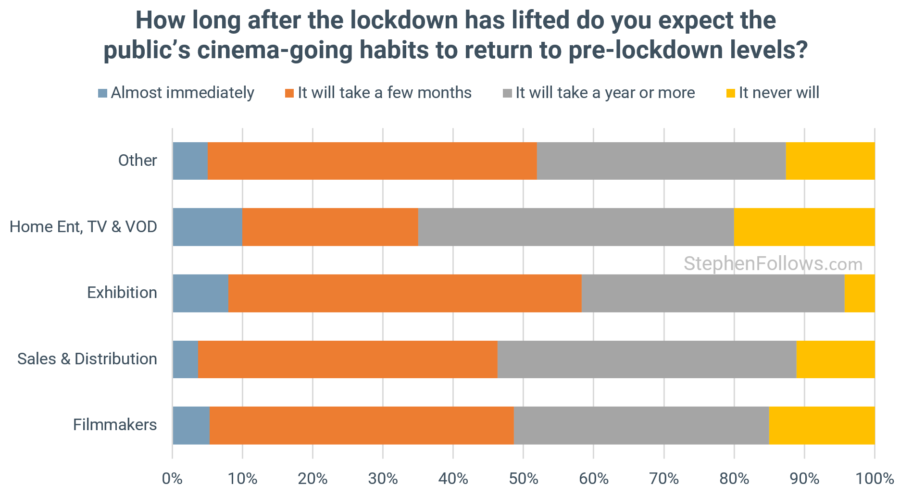

Respondents working in the exhibition sector were the most optimistic about a speedy return to pre-lockdown levels of cinema attendance. 58% felt that things would be back to “normal” within a few months. There were also the least likely to believe that cinema attendance will never return to pre-pandemic levels.

The reverse is true of those working in Home Entertainment, with two-thirds believing cinema-going won’t regain its former glory within a year, if ever.

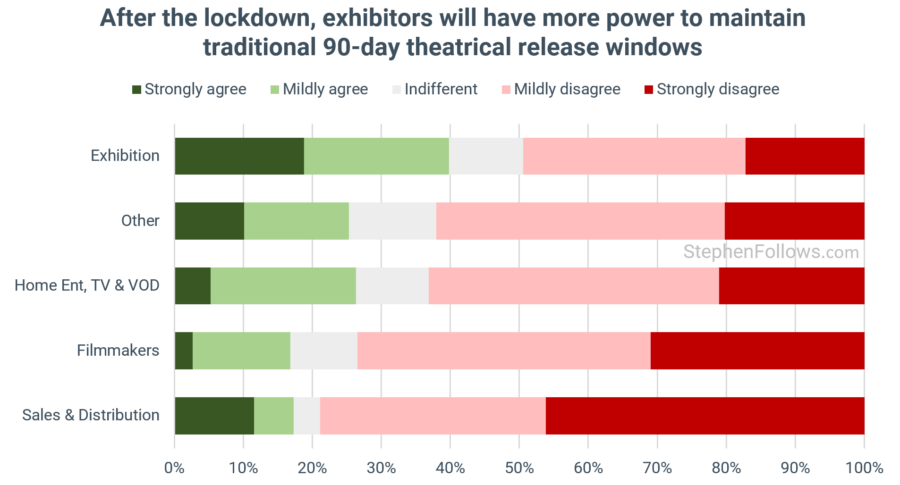

Exhibitors seem more bullish about their ability to protect exclusive windows than their peers in sales and distribution.

Solutions to aid recovery

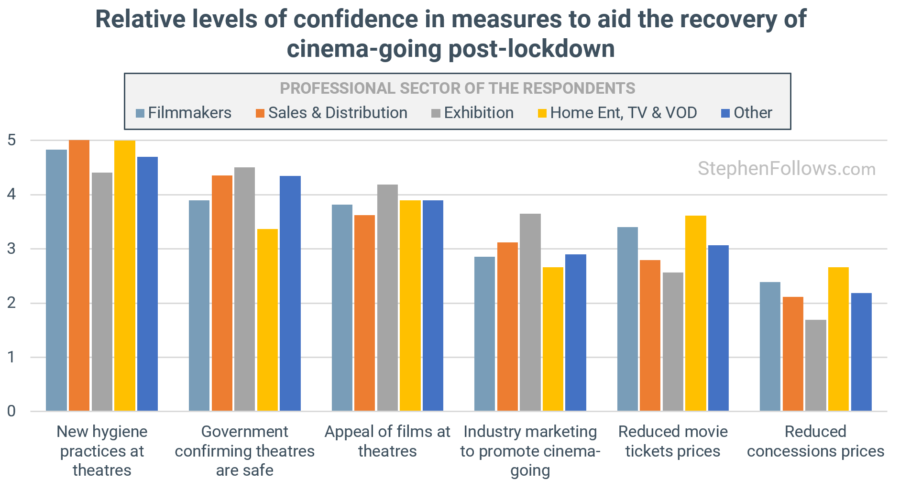

When quizzed on the merit of a number of possible actions to support post-lockdown cinema attendance, most agreed that price was not the defining factor.

The most popular measure overall was new hygiene and sanitation practices in cinemas, closely followed by a desire for government communications to declare cinemas to be safe.

The future

Perhaps the hardest thing to predict at the moment are the long-term effects of the pandemic. On the one hand, audiences have become more accustomed to paying more for VOD-first content and it may take a long time for them to feel safe spending a few hours in crowded public spaces. On the other, being cooped up inside may further highlight the appeal of the big screen and movie-going provides a (relatively) inexpensive social experience.

No matter how audiences respond, the biggest changes caused by the pandmeic are likely to be the ones taking place away from public view. The finely balanced power dynamics of releasing have been destroyed and the outcome is as-yet-uncertain. Studios may feel emboldened to further shorten theatrical windows and loss of months of income could harm some exhibitors’ ability to invest or even continue operating.

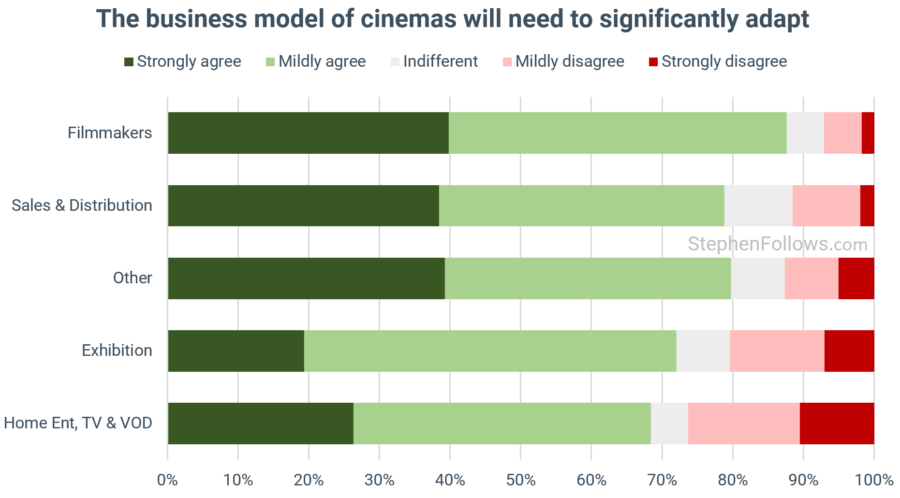

Perhaps the most surprising result from the survey is that all sectors in the industry recognise the need for change. Two-thirds of respondents in Exhibition agree than some change will be needed in the business model of cinemas.

What that change will be… is less clear.

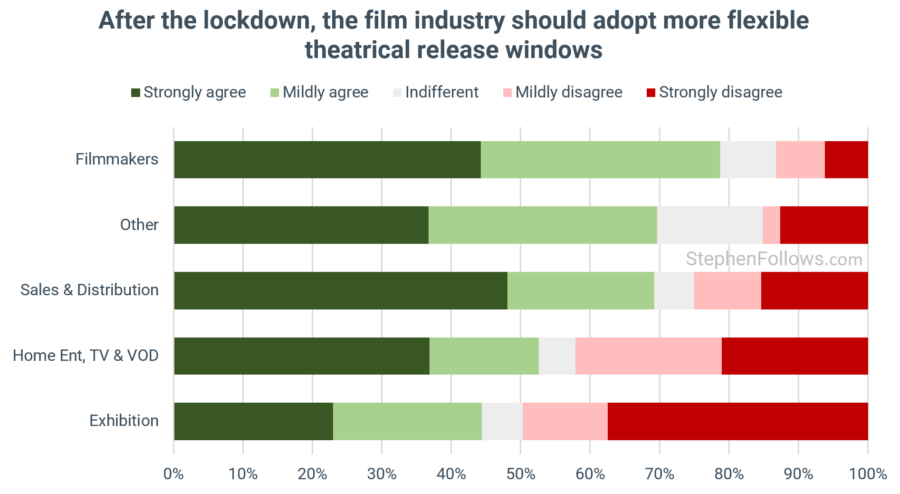

Despite the broad agreement that change is needed, the two ideas we tested provided a return to the polarisation we saw in earlier questions, with Filmmakers strongly in favour of change but with Exhibition folks much more resistant.

Half of the exhibition cohort thought that flexible release windows should not be adopted, compared with just 13% of filmmakers.

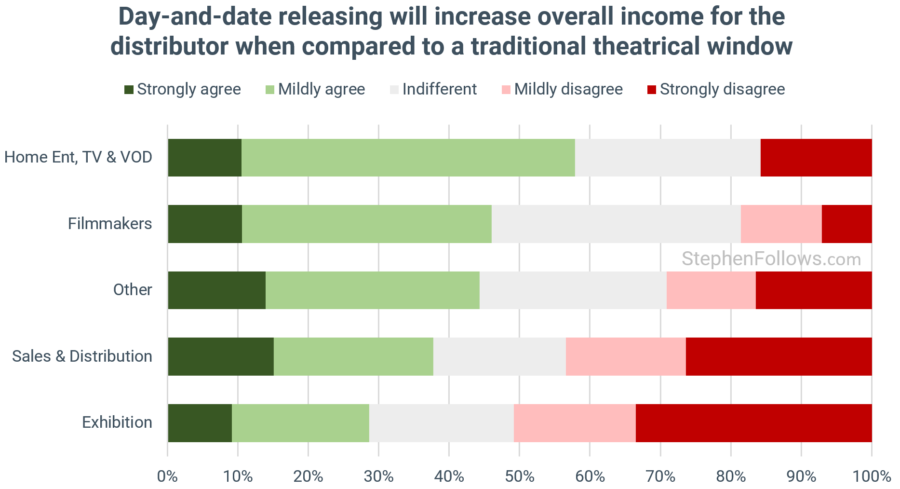

Finally, we asked if a day-and-date release (i.e. simultaneous release in cinemas and on digital platforms) would provide a greater overall income than the traditional window release pattern. As one would expect, those in home entertainment thought it would while those in exhibition thought not.

However, the key group here are those in sales and distribution, as they see the complete value chain and are seeking to maximise revenue across all platforms. In this case, they broadly agreed with the exhibitors, implying that perhaps we are not on the cusp of a day-and-date revolution quite yet.

Notes

This survey was conducted between 4th and 14th May 2020. Respondents were self-selecting and we cannot know to what extent their views are shared by others.

We focused on the domestic market as 94.5% of our survey respondents were based in the United States or Canada. 58% of respondents were at senior or top positions in their companies and 81% expect to be still working in the industry in five years’ time

Comments

Cinemas have been slowly dying for quite some time. Now the C19 crisis has accelerated the onset of their demise. Most cinemas are uncomfortable, the sound and picture is badly presented and going to the movies has become somewhat unpleasant. They have a choice – either invest in better seating and better ancillary services and get 3D sound and better projection into the theatres now, or pack-up and go home.

Thanks as always for the research. What I take away is how unclear everyone is about the reality of this unparalleled COVID-19 experience. The research also tells me that despite the difficulty of predicting the future at this time, that in general, people imagine a future that takes into account their own agendas.

Thank you for providing these survey results. Here is another perspective of what it looks like when a cinema chain partly reopens in Texas:

“..the chain has only opened up 3 out of their 9 theaters, and they’ve welcomed an average of 3,000 moviegoers over the past three weekends. Ticket sales are about 15% of what they normally are.”

Only time will tell if brick and mortar will survive this pandemic. Having done both theatrical four walling and virtual cinema self distribution with my films, I wouldn’t give up one for the other, they both now have more of an equal place in our media consuming ecosystem.

Source:

https://www.vice.com/en_us/article/pkyd4z/what-its-like-to-go-to-the-movies-during-a-pandemic

With better home viewing equipment at lower prices, and rising costs of a theater-ticket, accentuated by the pandemic lock-down, it is clear something must change. AMC theaters was on the cusp of bankruptcy earlier this year. Other factors then are – will there be less movie theaters for an audience?

Theaters must evolve to survive. As it is now, most are notorious for sticky floors – so how would one feel safe after CV19? How clean will theaters [and their restrooms] be? How will the snacks be served to assure safety of the customers?

Bold steps will be needed to save the movie house. Better seating, wider aisles…clean clean clean …. and that overpriced food stuff needs to be greatly enhanced. Otherwise, it is cheaper for a family of 2-3-4 to stream safely, and more affordable at home.

And the studios – and filmmakers – will need to find ways to lower the production costs to increase the chance of profit via streaming.

As a budding filmmaker, I’m taking this opportunity to consider how I’ll exhibit my films. Could it be that I invest in a state-of-the-art pop-up outdoor theatre set up and tour the country? Could I entice people to sit in the comfort of their cars to watch a small group of people from a coastal town open to the miracle of being alive? Could I bring back the ancient art of a traveling roadshow? If I build it, will they come?

Yeah, but can the film industry do without the money coming from cinemas?

Thank you for this helpful perspective on how this pandemic affects 21st century film-making…. Interesting how that regardless of HOW it survives, it is clear that it WILL survive — in some new ways, perhaps, that are not yet on your survey.

Great research. With more studios and mid-majors creating or buying AVOD/SVOD platforms they will deliver less product to theaters, opting to release directly to their paying consumers. If Disney has 100 million paying subscribers that are giving them $5 or more a month, why would they feel the need to split profits with theaters when they don’t have to. With less product, theaters will be force to shed large amount of their real estate portfolio and only the largest movies from creators that demand theater exhibition will see the silver screen. This isn’t the fault of the creators, this is the theaters own doing. Ticket prices aren’t the problem in most areas of the United State, its the high cost of concessions that make it a $100 trip for the average family of 4. $100 that now has to compete with streaming platforms that are a 10th of that cost and far more convenient for that family.

People said cinema was dead with the onslaught of VCR’s and Blockbuster Video. Home theaters..and now COVID. People don’t understand that it is not just about the film that is part of the experience of the cinema. It is the total encapsulation, the collective emotion felt. As a scholar and festival director, I am confident that cinema will remain intact, in fact it will have a renaissance. There is nothing like experiencing art with others.

EXACTLY, THE WHOLE EXPERIENCE IS WHAT MATTERS THE MOST . CINEMA IS BETTER AT CINEMA

If you actually study the graphs, you will see that the exhibitors think that “everything will be alright”, while everyone else thinks they’re screwed. I side with everyone else.

That’s the way it’s always been and “everyone else” have always been wrong.

If you actually study the graphs, you will see that Eugenia did not actually study the graphs. Nuance…nuance.

This is amazing stuff.

Any chance we can get a an updated version of this given how quickly the world has changed in only a few months.

Thanks for your great work!

Stephen, awesome stuff. Would love to get your thoughts on the 17-day window deal between Universal and AMC.

Hi – I would love to see what the % shift is to pirate viewing. I have noticed that many people post lock down are now watching and sharing movies for free and don’t seem too guilty about it. Like they have a good enough reason now to do it. It is a huge shift at the moment and I want to find out if anyone else agrees with me that the whole industry may not be sustainable if that increases?

Hi Stephen,

Solid research! I’m particularly interested in the graph in the “Solutions to aid recovery” section. What were the metrics for industry marketing? I’m interested in whether technological advancements and new premium formats was a factor. Thanks in advance.

It’s been a while and it was good to come across this again now its Jan 2022.

Although there are many spreading optimistic propaganda as Spiderman has been an amazing success. Cinemas hand been profitable for a few weeks over christmas.

As a cinema owners I am not so excited as, “One successful Movie does not make an industry”. We had a glut of tent poles like never before rolling into Christmas. Variety stated in a year roundup. Christmas films (apart from spiderman) were Flop or Soft. I would have to agree.

We may have had GROSS levels in the area of pre pandemic levels but from my perspective, we should have been 120-130% pre levels due to the glut of tentpoles.

The result to me indicates a trend reduction in attendance over the last 20 years has jumped 10-20 years, resulting in a 20-30% drop in attendance per year per person is most likely baked in going forward.

This is not the end of cinema, but it’s in for a world of pain before it can reach equilibrium again. (In established markets)

As the data above indicates, exhibitors have an overblown opinion of their importance. I am an exhibitor and I completely agree with this observation. I am not Exhibition born and bread so have an external mindset. I feel incumbents simply don’t understand how the changing environment is changing consumer behaviour. They simply refuse to see it. Most expect GROSS levels to come back to what is was before. Sorry, statistically that’s impossible.

Until those in position of power take on these truths, I don’t see anything changing. Only after the $h1t has hit the fan, and the damage it extreme will eyes open to the reality that the cinema industry needs to change. (Interesting, all other sectors, apart from exhibitors/Distributors, appear to already realise this fact based on the data above.)