Today I am answering a question from a reader who got in contact to say “I am working on a project right now and the investors are asking how long it will take to get their money back. Have you any idea what percentage of total lifetime revenues the average movie earns in Year 1, Year 2, etc?”

Today I am answering a question from a reader who got in contact to say “I am working on a project right now and the investors are asking how long it will take to get their money back. Have you any idea what percentage of total lifetime revenues the average movie earns in Year 1, Year 2, etc?”

Analyzing return in the film industry is always tricky, due to the fragmented and secretive nature of deals. However, there are a few places we can look to gain an insight into otherwise opaque areas.

In this case, we can study the returns of films backed by the British Film Institute (BFI). As a quasi-public body, the BFI is required to report the status of investments it has made each year in its full annual accounts. This means we can see how much the BFI put into a film and how much they earned back.

The average recoupment period for movies

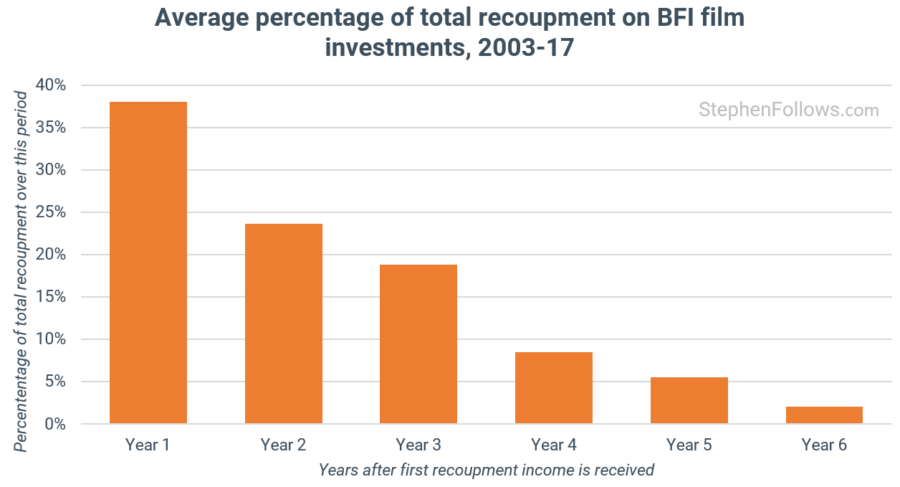

I studied 328 feature films which received funding awards from the BFI (or its predecessor the UK Film Council). By piecing together the annual accounts we are able to get a picture of when money flowed back to the BFI.

Over this fifteen-year period, just over a third of all the money came in during the first year of recoupment, with 89% being received within the first four years.

Examples of recoupment schedules

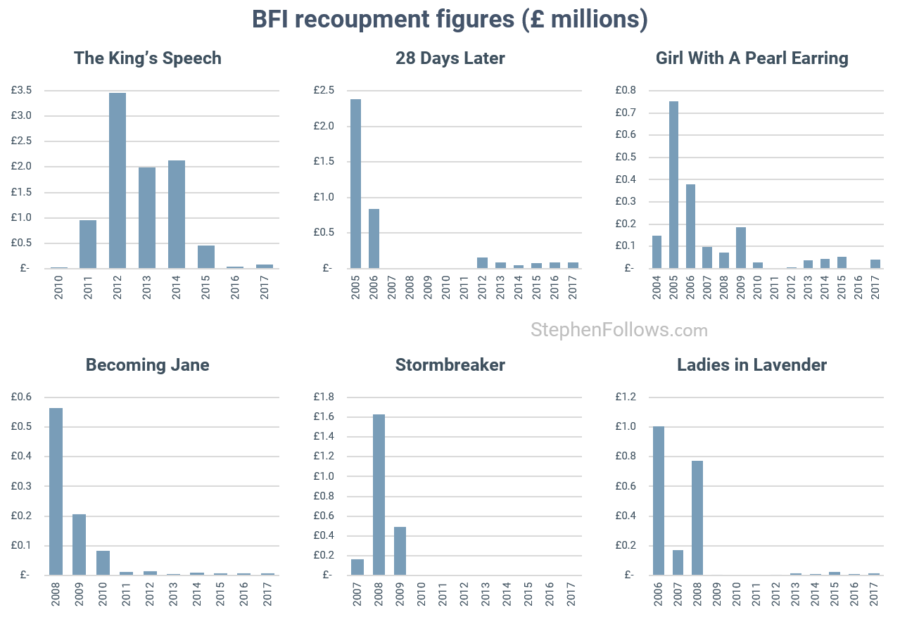

Each film will have a slightly different recoupment pattern. For example

- Slow burns – An independent film can take time to get noticed and to gain worldwide income. For example, The King’s Speech was unusual in that it took a couple of years to hit its peak as it was released internationally and eventually went on to win the Best Picture Oscar.

- Up-front deals – A distribution deal could include a Minimum Guarantee (MG) which is deducted from future income. This can result in no income for a number of years while that MG is repaid. Most films never repay their MG but those that do will see a small trickle of income after that period. For example, 28 Days Later saw a large income in years 1 and 2, then nothing for a further five years, after which time money started coming in again.

Below are four examples from the BFI dataset. In each case, we’re only seeing the BFI’s share of income so sadly we cannot use them to calculate the total income each film received. That said, with the BFI earning over nine times its original investment on The King’s Speech, we’re able to conclude that the other investors must be pretty happy right now!

What this means for filmmakers and investors

In a 2004 Wired article entitled The Long Tail, Chris Anderson described a scenario whereby companies can make more money from selling a large number of low-volume products than by just stocking a few high-demand items. I have heard many new or inexperienced filmmakers refer to ‘the long tail’ as a key part of their recoupment plan. They envisage a world wherein even if their film does not make much in its first few years, it will go on to succeed by selling for a number of years.

As we have seen above, sadly this is extremely rare for film recoupment. In almost all cases, the money you generate in the first few years will represent the vast majority of lifetime income.

The exceptions to this rule are:

- Films which spawn other products which live on, such as popular video games, live shows, albums etc.

- The value generated from remakes, sequels, spin-offs etc.

- If the topic or star gains greater fame or relevance long after the film’s initial release (a case in point is any movie which featured pandemics right now!)

As you can imagine, these are fringe cases which rarely apply to indie films.

Further reading

Here are some past articles which will allow you to read deeper into the topics touched on today:

- How movies make money: $100m+ Hollywood blockbusters

- The scale of BFI development and production funding

- Which BFI funded films returned the most money?

- Do BFI backed films make a profit?

- Do Hollywood movies make a profit?

- What percentage of independent films are profitable?

Data

The raw data for today’s study came from the BFI’s annual accounts. This means that it is historic data and refers to a particular type of movie. That said, the overall pattern does match the recoupment schedules I’ve seen for all manner of movies, from studio blockbusters down to micro-budget breakouts. Each film will have its own unique division of returns between years but overall the average pattern is likely to be as shown above.

In order to conduct today’s study I built upon previous research I had conducted into BFI (and previously UK Film Council) funding. There are a number of notes and caveats mentioned in those projects which are worth considering. For brevity’s sake, I will not repeat them here but they can be read at the BFI-related links above.

As this is annualised data, we do not get the kind of granular detail which would be more useful for cashflow purposes. For example, if a sales agent is paying money quarterly, is slow to make transactions and pays on the first day of a new financial year, then this will show up in the figure long after it was actually earned. However, I hope that the volume of films studied here minimises the effect of such fringe cases, and readers are reminded to take into account this kind of lag when discussing payments.

I updated this article soon after publication as I discovered that a small number of my figures for the year 2003 were wrong. I have now fixed them.

Epilogue

The BFI data was not in the easiest format to read or analyse, which one can only assume is deliberate, given how easily other information is made available by them. Given that the BFI hold all the data, it would be fairly straightforward to link this returns data and present it as neatly as they present their funding awards.

I suspect that one factor which is depressing action on this front is that BFI films rarely pay back their full award. Put another way, the vast majority of BFI-backed films do not breakeven. When I previously studied BFI returns, I spoke to many members of BFI staff at all levels and the consensus was that this was a PR concern and something the BFI doesn’t want to highlight. PR is not my area so I can’t say to what extent this fear is justified, or if the potential fallout is worth frustrating industry research.

What I can say is that not only is the lack of profitability no black mark against the BFI, it could even be read as evidence that they’re performing their role correctly. A few things to bear in mind:

- They are not designed to be a profit centre. They spend government and National Lottery money to improve and strengthen the UK film industry. They are part arts body, part trade body and part force for social good (i.e. improving access, diversity, education and opportunity). Their missions are hard enough already without also adding “make money” on!

- They are filmmaker-friendly. One route to larger returns would be to toughen up the deal terms for the money they provide. By demanding an exclusive and/or early recoupment position they would no doubt increase their chances of breakeven, but at the cost of making any other investment in the movies much harder. Another project the BFI have is their Locked Box scheme, which means that a significant share of profits is returned to the filmmakers to make future films, further reducing the BFI’s income but increasing the advantage to filmmakers.

- The kinds of films the BFI fund are not the most profitable type. Due to its arts and diversity remit, the BFI is carefully choosing which films to make. They disproportionately fund period dramas and rarely support horror – the complete inverse of an investment strategy chasing a return.

- Most indie films lose money. Across the whole sector, only around a third of theatrically released movies turn a profit and for the lowest budget range, it’s fewer than one in twenty-five.

So from my perspective, I would hope that the BFI further open up their data in a format researchers can easily use. The collation and re-formatting of this return data took many, many hours of work, just to recreate what the BFI already hold in a structured format.

Comments

Hi – do you have the BFI/UKFC awards for the six example films? The http://www.bfi.org.uk/film-industry/funding-awards page does not show any results if the titles are entered (unless there is a glitch).

I think it would be useful to know how the BFI/UKFC films have performed relative to awards, ideally by title (the lottery players do pay for the awards) or at least aggregated in some way ie x% recouped 80-90%, 22% recouped less than y% and for each band. I agree making a loss is not a bad reflection given the remit, and it may in fact show that film stands up as an investment. If you look at the performance of investments funded on platforms like Seedrs and Crowdcube, across sectors but many of them “tech” investments so in vogue, the results are not great. There is the odd outlier like Revolut, but the crowd investors generally have a rubbish deal for their shares, but the vast majority have gone bust or are “zombie” companies hanging around doing nothing, so a 100% loss. They just keep going until the money is gone. Whereas once a film is made it is an asset and will generally sell and get at least something back.

Some of them were pre BFI, and the current BFI choose not to publish UKFC data in the same way. Here are the total awards:

28 Days Later – £3,225,000

Becoming Jane – £1,513,062

Girl With A Pearl Earring – £2,000,000

Ladies in Lavender – £1,979,850

Stormbreaker – £2,400,000

The King’s Speech – £1,021,080

Based on this I have the very approx income / return on investment as:

28 Days Later – £3.7m / 15%

Becoming Jane – £850k / -43%

Girl With A Pearl Earring – £1.8m / -10%

Ladies in Lavender – £2m/ 1%

Stormbreaker – £2.3m / -4%

The King’s Speech – £9m / 800

Split over years so for 28 Days Later it is like 7.5% pa average.

Combined £19.65m on £12.2 investment a 61% ROI overall, but very reliant on The King’s Speech.

The current C19 crisis is turning the movie industry on its head. It is now a question not of IF a movie make money, but WHEN. It also means that theatrical release is a thing of the past. We may pick a theatre for the premier but that’s about it – a nice place to show a movie for the first time. After that, it’s PPV.

I’m not sure I agree with Andrew but as someone whose film is in indy film land with a small distributor. When doesn’t happen for all films, and sometimes really bad movies make the bucks. But – The number I’ve seen in the US is the 5 year returns possible model (with a 10 year – don’t give up yet sometimes)

Unfortunately, we don’t have many of the funding avenues available in other places, we are truly the wild west of production funding. The issue is made more blurry by lack of data here as well. Streaming is all well and good and indeed is the future, the problem is that streaming at .10 – .30 cents a view ( return back to film company) will take a really long time to payback. Theatrical release serves the purpose of getting peoples attention. Blu-Ray is also more of a advertising gimmick although there is still a market there. However, unless there is someone really big in the movie, small movies get lost in the shuffle. Speaking for myself and the 70K film that I have out in the world, Our income back so far is around 300.00 Our distro person indicates that this will increase and that we shouldn’t panic yet. Before anyone snarks at me – We had 15 festivals world wide with 5 of 7 wins that were having a best film selection.

Did I miss a article that addressed the value of the film festival to indy films ? One that addresses small festival value as well as that of major festivals? If not, perhaps that would be of interest

I realize this article is a few years old, and this is fascinating information. The landscape for film economics has changed so drastically over the last 15 years and especially over the last three that it may warrant a completely new look at today’s marketplace and deals.

Before 2008 the $5-10 million dollar movie could make money going to straight to DVD, and in fact a lot of distributors were choosing that route instead of taking perfectly good films that might have done well theatrically and eschewing the ever growing marketing spend necessary to get them on thousands of screens in the US. After 2008 the video stores began disappearing and with them went the $5-10 million dollar feature. If your budget was over $1 million you *had* to go theatrical to have a chance to make money. This called for capital raises for prints and ads much larger than the film’s budget. Naturally people didn’t want to do that and we began to see the death of the small drama (and franchises like Road Trip and Bring It On, which were DVD dynamite). It also caused a great deal of heartache to the “middle class” of actors and filmmakers who made their livings from middle-budget properties.

Then due to Covid-19 theatrical, which was dominated by tentpoles anyway, went away. While it is only slowly returning it is still mostly supporting only the biggest releases. This means the way most people are experiencing films is through streaming services, which are controlled by studios, companies that are becoming studios, or tech behemoths. I am wondering what the value of licensing rights and views are on such platforms, and how this impacts the long-tail of returns.

It’s crazy to read old articles in current times and measure the rates of change. The positives and negatives.