For the past decade, DVD revenue has been shrinking rather quickly, due to piracy and changing consumer viewing habits. The industry is hoping that the new kid on the block, Video On Demand (VOD), can fill this shortfall. In 2014, I surveyed 1,235 film business professionals and found that 61% of them expect that within the next four years VOD revenue will be equal to the amount DVD generated at its peak. We’re still a way off that goal, but there’s no doubt that VOD income is becoming an increasingly important part of the film recoupment chain. In 2013, VOD provided 7.9% of all income generated by films in the UK, up from just 2.7% in 2008. Compare that with DVD stats (39% in 2008 and 23% in 2013) and the trend is clear.

For the past decade, DVD revenue has been shrinking rather quickly, due to piracy and changing consumer viewing habits. The industry is hoping that the new kid on the block, Video On Demand (VOD), can fill this shortfall. In 2014, I surveyed 1,235 film business professionals and found that 61% of them expect that within the next four years VOD revenue will be equal to the amount DVD generated at its peak. We’re still a way off that goal, but there’s no doubt that VOD income is becoming an increasingly important part of the film recoupment chain. In 2013, VOD provided 7.9% of all income generated by films in the UK, up from just 2.7% in 2008. Compare that with DVD stats (39% in 2008 and 23% in 2013) and the trend is clear.

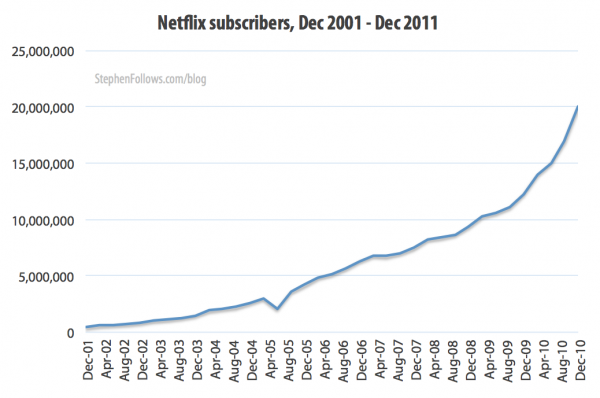

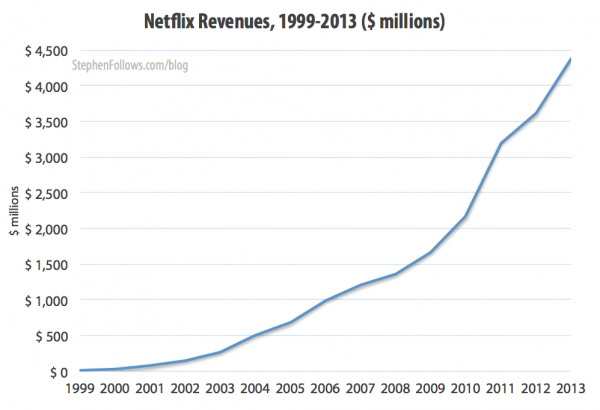

The biggest player in the VOD market is Netflix. It began in 1997 as a mail-based DVD rental service, adding internet streaming (VOD) services in 2007 and by the start of 2014 they were providing over 1 billion hours of movies and TV shows every month. In 2002 the company went public, meaning that it is legally required to publish a whole host of data. I spent some time going through ten year’s worth of annual reports in order to pick out useful data points on the economics of Netflix. In summary…

- In 2000, Blockbuster refused to buy Netflix for $50m.

- In 2013, Netflix generated $4.4 billion in revenue.

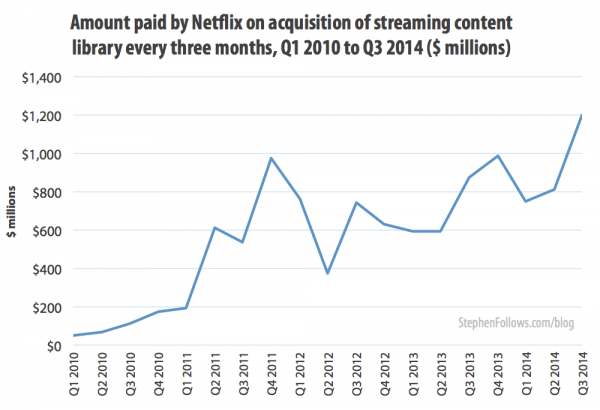

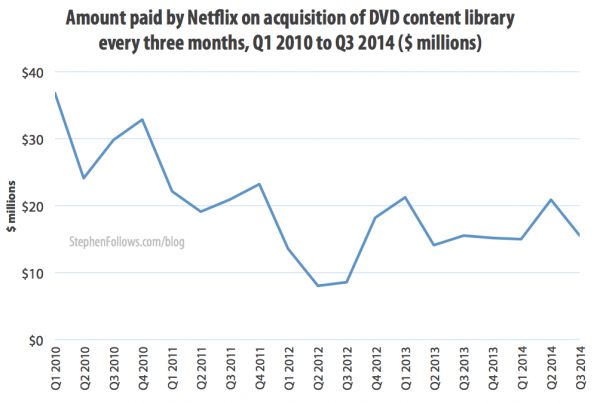

- In just three months (July to Sept 2014) Netflix spent $1.2 billion acquiring new content for its streaming service and a further $16 million on new DVDs.

- In 2013 Netflix spent $470m marketing its streaming service and just $0.2m promoting its DVD service.

- 10% of Netflix’s non-US streaming subscribers are receiving the service for free.

- In the US, 6 million people still pay for the DVD-only service.

- In the UK, 4.5 million people are Netflix subscribers.

- The average Netflix subscriber streams 45gb of film and TV shows per month.

How many people subscribe to Netflix?

In the early days of Netflix, it was DVD-only. When the streaming service was eventually added it was initially part of the same package, with subscribers able to stream one hour for each dollar they paid a month (i.e. those on the $16.99 plan could stream 17 hours each month). From 2008 this restriction was lifted and users could access unlimited streaming. As of September 2014, the average Netflix subscriber streams 45gb of film and TV shows per month.

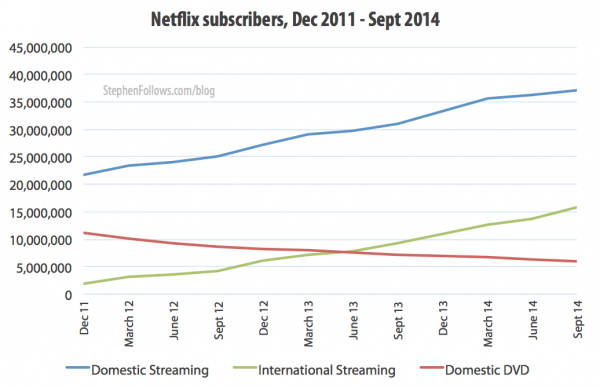

In the early days of Netflix, it was DVD-only. When the streaming service was eventually added it was initially part of the same package, with subscribers able to stream one hour for each dollar they paid a month (i.e. those on the $16.99 plan could stream 17 hours each month). From 2008 this restriction was lifted and users could access unlimited streaming. As of September 2014, the average Netflix subscriber streams 45gb of film and TV shows per month.  In July 2011, Netflix split the DVD and streaming parts of its business. The streaming service continued to grow and the DVD began to decline. Despite this, as of September 2014, almost 6 million people were still paying for mail-based DVD rental packages. In the UK, 4.5 million people are Netflix subscribers.

In July 2011, Netflix split the DVD and streaming parts of its business. The streaming service continued to grow and the DVD began to decline. Despite this, as of September 2014, almost 6 million people were still paying for mail-based DVD rental packages. In the UK, 4.5 million people are Netflix subscribers.  Note: in the following graphs, “Domestic” refers to America.

Note: in the following graphs, “Domestic” refers to America.

So they must be generating a lot of revenue?

The company was started with a seed investment of $2.5 million from one of its co-founders Reed Hastings. In 2013, the company generated revenues of $4,374,562,000 and it looks likely to beat that figure when the 2014 figures are published.

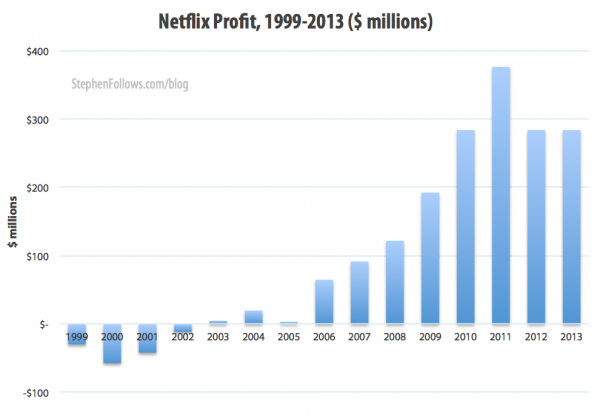

Are they making money?

Yes, and lots of it. In 2000, Blockbuster turned down the chance to buy Netflix for $50 million, or in other words, 18% of their 2013 profits.

How much does Netflix pay for its film and TV shows?

I’m afraid that exact amounts paid to film and TV distributors is rarely released on a ‘per film’ basis. However, we do have clear data on the total amount Netflix spent on acquiring new content. In the four years between 2010 to 2013 inclusive, Netflix spent $8.6 billion acquiring new films and TV shows for streaming and DVD. In just three months (July to Sept 2014) Netflix spent $1.2 billion acquiring new content for its streaming service and a further $16 million on new DVDs.

I’m afraid that exact amounts paid to film and TV distributors is rarely released on a ‘per film’ basis. However, we do have clear data on the total amount Netflix spent on acquiring new content. In the four years between 2010 to 2013 inclusive, Netflix spent $8.6 billion acquiring new films and TV shows for streaming and DVD. In just three months (July to Sept 2014) Netflix spent $1.2 billion acquiring new content for its streaming service and a further $16 million on new DVDs.  Netflix spends far less on acquiring new films and TV shows on DVD.

Netflix spends far less on acquiring new films and TV shows on DVD.

How much do economics of Netflix allow for spending on marketing?

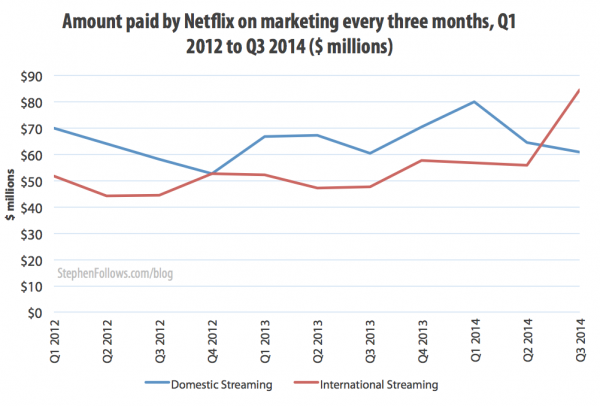

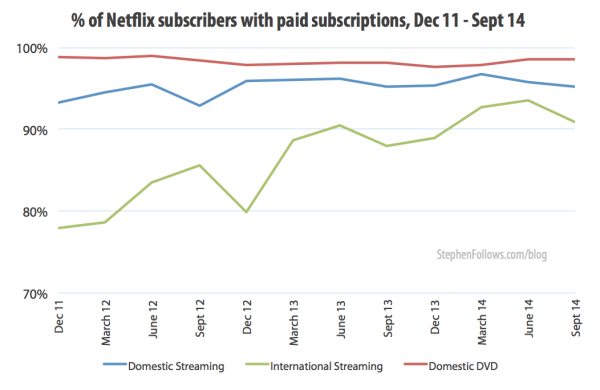

In Q3 2014 Netflix spent $146 million on marketing its streaming services and a total of $0 on marketing its DVD services. Yes, that’s not a typo: in 2014 Netflix has not spent a single dollar on marketing its DVD plans. In 2013, they spent a total of just $292,000 the entire year (the streaming marketing for 2013 cost $470 million).  Netflix seems to be following the example of AOL in the 1990s by offering free trials to any and everyone. I crunched the numbers on what percentage of Netflix subscribers actually pay for the service. In September 2014, 10% of subscribers to Netflix’s non-US streaming service were receiving the service for free.

Netflix seems to be following the example of AOL in the 1990s by offering free trials to any and everyone. I crunched the numbers on what percentage of Netflix subscribers actually pay for the service. In September 2014, 10% of subscribers to Netflix’s non-US streaming service were receiving the service for free.

Epilogue

I should disclose that I am a Netflix subscriber, and would count myself in the 63% of subscribers who say that they are “extremely satisfied” or “very satisfied” with the service. 2015 could be the year that VOD steps up to fill DVD’s empty boots. Despite this, the industry has been very slow to share data on VOD sales, prices and viewing figures. As a film stats bod, I find this rather frustrating. Hopefully in 2015 I’ll be able to uncover more data on VOD to share with you here.

Comments

Thanks for that. Very Interesting facts. Especially of interest to note that as their profits went up their payments for films stats went down. You’d think they’d be about level.

Very good analysis, thanks for that. If possible, the further insight I would like to see is how much Netflix pays per title for the rights to stream it. One of the effects that Netflix has had on on the industry is how the economics for rights holders have been changed by its acquisition of rights policies. Giving subscribers “all you can eat,” for one flat monthly fee is great for subscribers, while the content owners have a difficult choice in deciding to take what Netflix offers or try to find a way to get a piece of every sale, as they did in the old theatrical distribution model.

Really interesting analysis. Thanks for a great read. I’d also be interested to learn how much Netflix pays per title and how this compares with other distribution channels available to content owners/producers.

Megan,

It looks like we have similar interests. I hope we hear from Stephen.

I’m working on it 🙂 It’s going to take a different approach as I need to do work with a large number of producers. I already have some early data but not ready for publication yet.

Say you’be made a movie, how do you sell it to Netflix?

Netflix don’t have time to work with every filmmaker directly so they go through middlemen.

The standard route is that you get a Sales Agent who represents all of your rights (cinema, TV, VOD, etc) around the whole world. They will then find a distributor for each country. In each country, your distributors will be talking to their local office of Netflix.

This method may seem a bit mad in our current globalised world but it is the system that the film industry has used for almost a century. It was created before international business was so easy and before audiences in different countries started to expect the same content.

If you’re an independent filmmaker without a Sales Agent or Distributor then you would need to go through an aggregator. These guys will work on a fee or % basis but you won’t be giving up your rights in the way you do through the normal method

Thanks for a well researched fun article Stephen!

I come from an editorial background and was fascinated at the data-driven possibilities of VOD. For example, how Netflix don’t do pilots as they know what will most likely be a hit, thus saving much money and equally importantly, time.

1) Any ideas on how the viewing data of their subscribers look like? They have kept this under wraps for some time and understandably so, but I’m very curious at their claims of how the big data analysis of viewing patterns is driving content commissioning.

2) I wonder what the churn rates or the average subscription length are on Netflix?

It’s natural for a service that spends over $600 million in marketing to get new subscribers all the time, but a good vod service requires it to satisfy its customers one at a time so that they keep on renewing month-on-month. If data is being used in this direction it could be some powerful stuff!

Aki,

Thanks, glad you enjoyed it. In answer to your questions…

1)They are extremely private about how their tracking works but they have revealed that they track all manner of ‘events’. These include

According to Kissmetrics, “Netflix also looks at data within movies. They take various “screen shots” to look at “in the moment” characteristics. Netflix has confirmed they know when the credits start rolling; but there’s far more to it than just that. Some have figured these characteristics may be the volume, colors, and scenery that help Netflix find out what users like”.

2) Netflix no longer declares their churn rate. They used to be very open about it but I guess they were burnt when in 2004 an investor sued them for under-reporting it. More about that here http://www.globenewswire.com/news-release/2004/08/10/314172/62086/en/Investor-Notice-Murray-Frank-Sailer-LLP-Announces-Shareholder-Lawsuit-Against-Netflix-Inc-NFLX.html

For example, in 2000 Netflix declared 515,000 new subscribers and a net increase in overall subscribers of 185,000. From that we can infer that they lost 330,000 subscribers that year, or an annual churn rate of 308%.

The last year we have enough data to be able to guess the churn rate was 2010. The full data is as follows…

This is all DVD subscribers, not VOD. Sadly we have no way of knowing what it is today.

Stephen,

thanks for your wonderful article and your input.

Is churn % calculated against the new subscribers or against the cumulative subs?

Nothing mentioned about sudden slowdow of mail by USPS, ad/or throttling onthe part of NetFlix of dvd customers. Much unhappiness amond customers

Do you know how much Netflix spends on IT? That is a key element of their VOD model as they probably have to address bandwidth, AWS costs etc.

Hi Stephen, I’m doing a school IB Statistics project on the influences of Netflix accounts on the amount of tickets sold in theaters. But I was wondering if you could tell me the exact breakdown of Netflix accounts/subscribers from 2001-2010? Thank you so much, this article was very helpful.

What an absolutely fantastic article. You’ve helped a lot with by uni project! Thank you and am looking forward to more great and informative articles on your blog!

Thank you Stephen for your dedicated research into this subject. I’m a filmmaker turned producer, my background and college training is in filmmaking, but my producer skills are, you could say OJT (On the Job Training). I came across your blog while I’m researching for my 5 film slate package and I was wondering if VOD’s was a sure thing to add to my marketing strategy. Based on what I’ve read it looks like a sure bet, so if I haven’t misinterpreted anything, VOD’s are on the menu.